Part IV — Sorting the Signal from the Noise: Prioritizing Patent Reviews

A detailed review of patent claims is always required, especially in litigation and transaction: patent practitioners may take a few days, weeks, or even months to review patents, search for relevant art references, and even interview technical experts.

Companies with an extensive portfolio often face and deal with thousands of patents and identifying the most noteworthy ones becomes a necessity.

Filters such as patent office, legal status, and patent applicant/owner can benefit prioritization when it comes to reviewing patents.

Some practitioners may also have developed their own set of advanced parameters such as forward citations, family size, number/length of independent claims as a more effective way to find out which patents should be reviewed first.

Similarly, the Patent Quality and Value Rankings can function as useful filters with perhaps even more relevance in the scenarios mentioned earlier.

Scenario 2: Evidence of Use Evaluation in Patent Assertion

In patent assertion, carrying out an Evidence of Use search is potentially an issue for two main reasons :

- Tearing down products to produce claim charts can be costly;

- Even if a convincing claim chart is produced, the patent still needs to successfully go through a prior art search to prove its validity.

Since the try-error cost can be significant, a preliminary review is crucial for the evaluation work to be efficient and cost-effective.

However, a preliminary review might still take a great amount of time for patent holders with large portfolios.

Fortunately, Patentcloud’s Patent Quality and Value Rankings can provide predictions on the relative likelihood of patents of being practiced (capable of generating a claim chart) and not being invalidated (capable of overcoming a validity search).

In a market adoption evaluation, an effective way to pickup a smaller subset of patents for the first round of the subject-matter expert’s review is to identify family members in major markets with Patent Quality and Value Rankings higher than A (except for the Information Disclosure Statement (IDS,) there are almost no formal rules or penalties for patent citations. The citation data is also limited to the search capability of applicants and examiners).

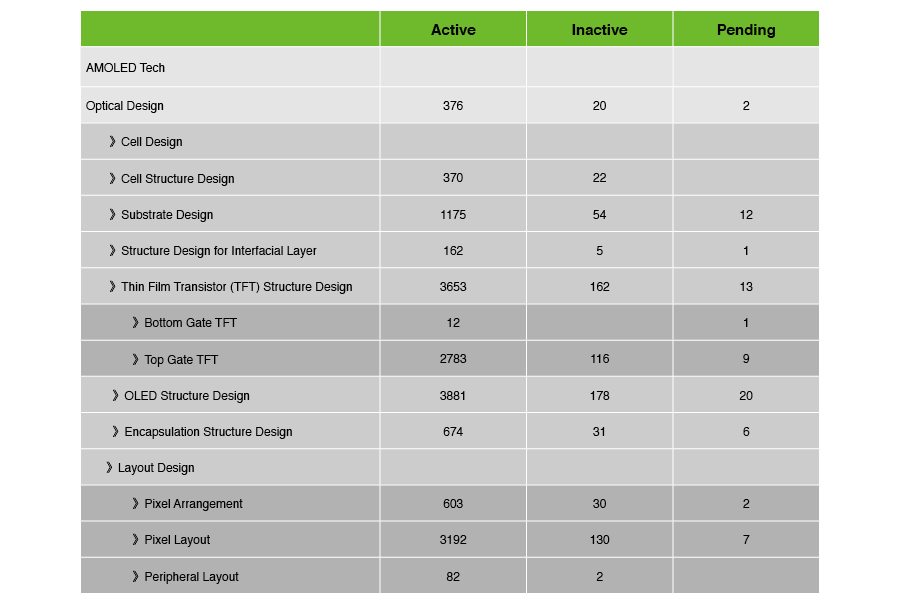

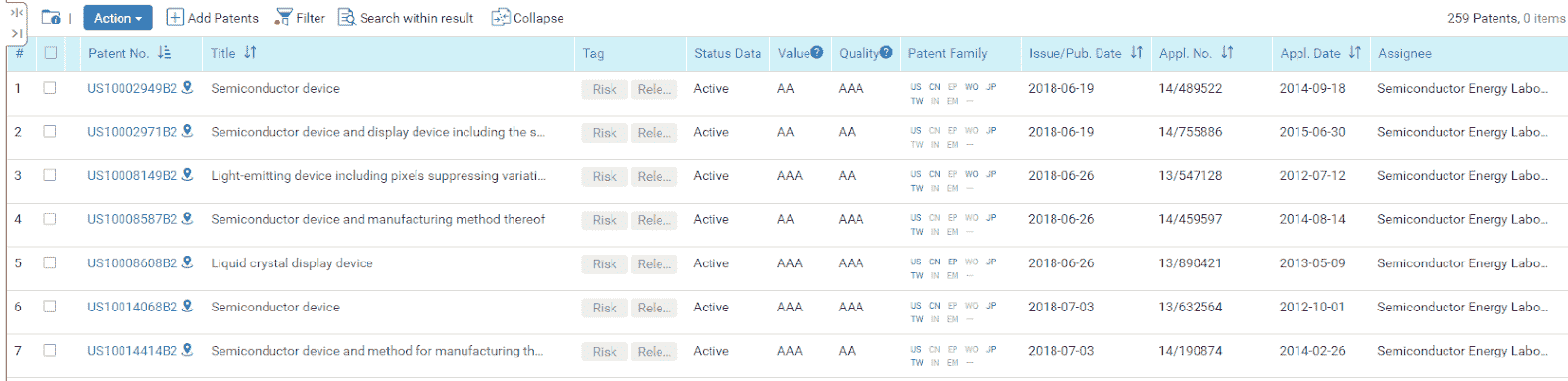

Let’s take, as an example, the 3,653 active US TFT patents owned by Semiconductor Energy Laboratory (SEL):

By filtering out those with Patent Quality and Value Rankings lower than AA we obtain a smaller set of 259 US active patents to review first:

For patent portfolios that have already been evaluated for their value — such as the SEPs — the Patent Value Ranking may not be an appropriate filter.

However, the Patent Quality Ranking could still be a useful tool for narrowing down the scope of the review, based on the patents’ tendency to overcome prior art.

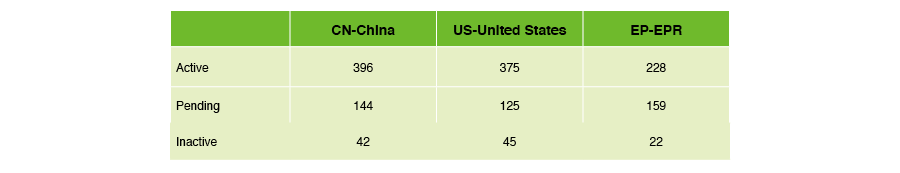

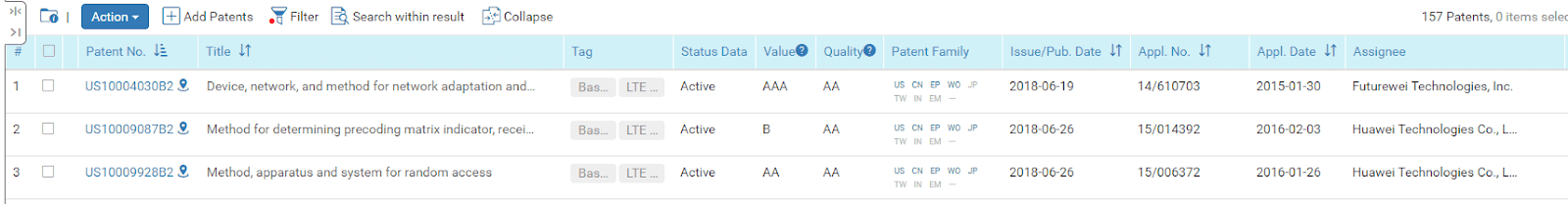

For example, as shown below, there are 375 active US patents that have been declared as 3GPP SEPs under the Technical Specifications (TS) 36 Series:

After filtering out patents with a Patent Quality Ranking lower than AA, we obtain a smaller portfolio of 157 US active patents to review first:

Scenario 3: Patent Clearance Scope Setting

For companies with products on the market — most notably in the United States, Europe, and even in emerging markets such as China or India — patent risk is one of the defining elements of their commercial success: a patent clearance search is the standard process for identifying and controlling these risks.

For startups seeking opportunities in cutting-edge technology fields, it is usually simple to limit the search scope and determine the company’s core technology.

However, as the industry moves towards maturity, new entrants join the field and file more patents. At the same time, the technologies involved in a product often become more sophisticated, making it harder to determine the relevance of a specific patent to a product.

As a result, the scope of a patent clearance search can become vague and some companies — especially in Asia — may even give up on controlling patent risk and simply allocate a budget for taking licenses.

As history has shown so well, preparing for risk is always more cost-effective than settling it when it occurs: Patentcloud’s Patent Quality and Value Rankings can help set the scope of a patent clearance search when a product becomes more complicated, and the number of related patents continues to increase.

Traditionally, practitioners take into consideration jurisdiction, legal status, and even current patent owners in their practices for patent clearance searches.

As the patent filing trend continues to rise, however, some industries — such as LCD, LED, wireless communication, mobile phones, lithium battery, and electric/unmanned vehicles — can easily involve thousands of active patents in each major country.

It would be better for practitioners to define the product and the criteria for determining the relevance of a patent to it. In this way, they could then evaluate the relevant patents based on the likelihood of infringement.

While there would still be thousands of relevant patents, the Patent Quality Ranking could be useful when limiting the search’s scope, so that the preliminary review could start with the patents that have relatively higher quality (those that are relatively less likely to be invalidated).

By identifying patents with a Patent Quality Ranking higher than D (the top 25% most likely to be invalidated), practitioners could somewhat narrow down the scope: if a patent holder takes the D-ranked patents against the product, it should be possible to settle the risk by invalidating them.

As the product becomes more sophisticated, practitioners may not be able to gain a comprehensive product definition to be used when judging the relevance of the patents.

The Patent Value Ranking may be helpful for a first round search and review, under the assumption of the relative likelihood of patents being practiced or monetized (including litigation).

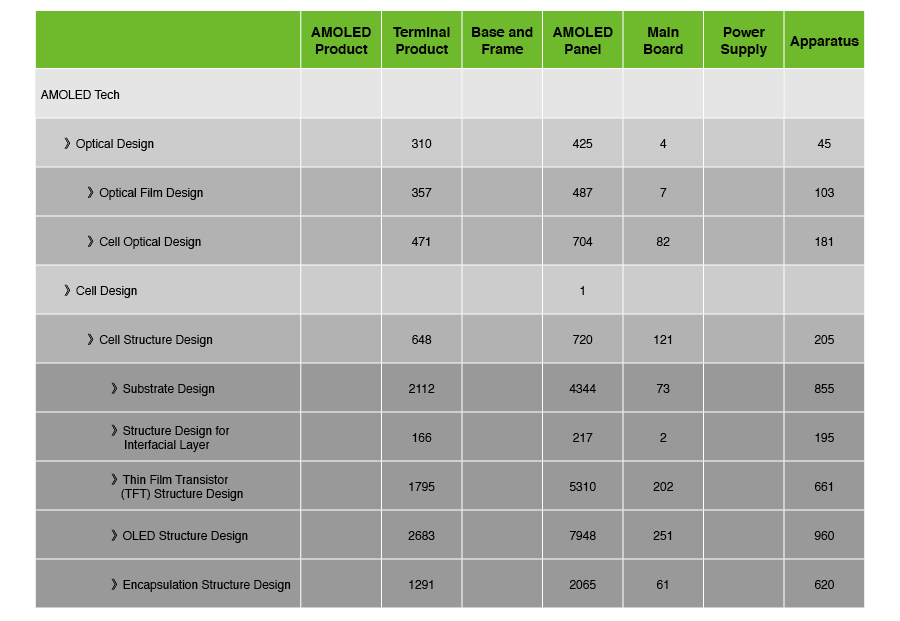

For example, as we examine all the active US patents related to AMOLED products and technology, we notice that we have 8,956 patents to review. Even if we focus only on the AMOLED panel patents related to the TFT structure design, there are still 5,310 patents to be examined for patent risk.

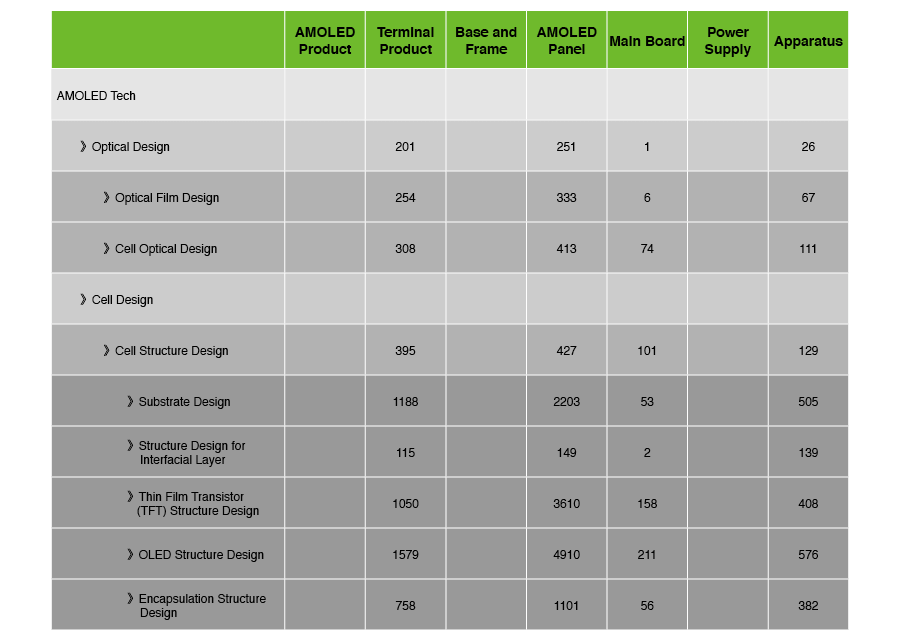

By screening out D-ranked patents, we end up with 5,261 US active patents that are not the least likely to be practiced and not the most likely to be invalidated. Out of them, only 3,610 AMOLED panel patents are related to the TFT structure design:

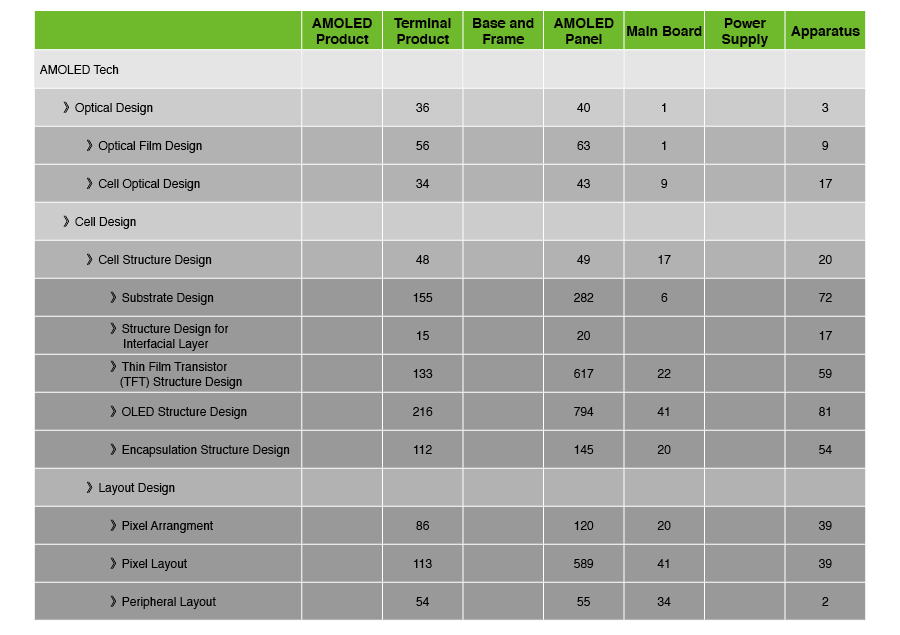

If we further set criteria for Patent Quality and Value Rankings to be higher than A, as shown below, we end up with 829 US active patents to be reviewed first: they are the most likely to be practiced and the least likely to be invalidated.

For the AMOLED panel patents related to the TFT structure design, there are only 617 patents left:

To check out the other articles in the series, follow the links below:

Download our white paper Patent Quality and Value Rankings to discover how the Patent Quality and Value Rankings work in detail.