Due Diligence

Patent portfolio evaluation made easy.

A picture is worth a thousand words—even more so, an interactive chart. Turn sterile patent data into meaningful dashboards with Due Diligence and say goodbye to grunt work forever.

Bring data to life.

Patent data hides a wealth of information. More often than not, most of that useful information gets wasted with tools that only tell part of the story, leaving you exposed.

No more grunt work

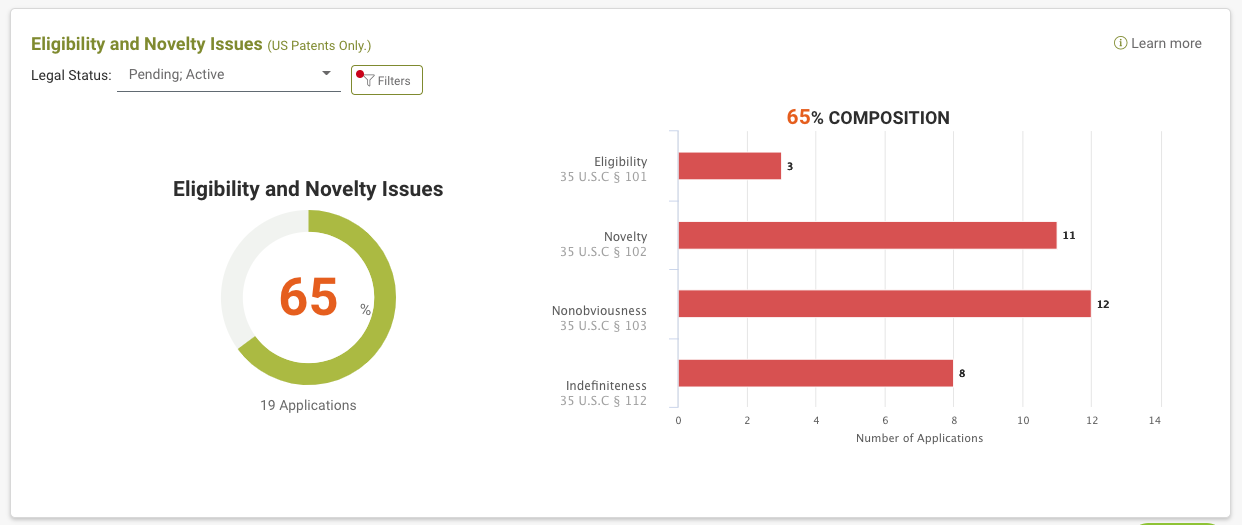

Due Diligence eliminates repetitive tasks while simplifying those that are traditionally a challenge like identifying patent validity issues or forward citation applicants.

Find diamonds in the rough

The portfolio is analyzed to highlight those patents that have the most potential to generate revenue through licensing or enforcement—the ultimate goal of patent due diligence.

Set yourself up for success

Most industries nowadays have entered the AI era—not the patent one. Due Diligence, with its machine learning algorithms, gives you a competitive advantage over your competitors.

Maximum value, minimum cost.

100%

The time you can save on data processing

There’s no need to waste time collecting, cleansing, and analyzing patent data anymore—we do that for you.

0.005%

Of a patent’s price

The average price of a patent in a transaction is $200,000. Know its ins and outs for just $10—before investing.

From complexity to simplicity.

Don’t panic over huge and complicated patent portfolios. Due Diligence’s dashboards give you all the information you need: once you get to the end of the page, you’ll know what to do next.

A complete toolkit.

Discover what’s going on within the portfolio—before it’s too late.

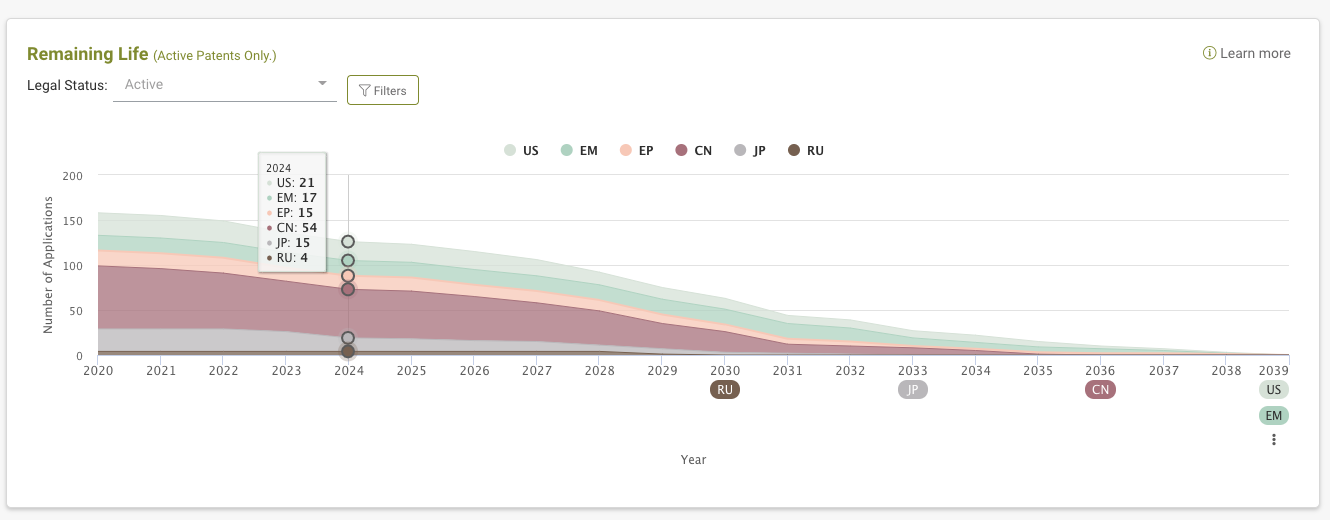

Coverage and Status

These dashboards help you decide whether to keep going with the analysis or stop right away: global coverage, remaining life, and pendency — is the portfolio worth my attention?

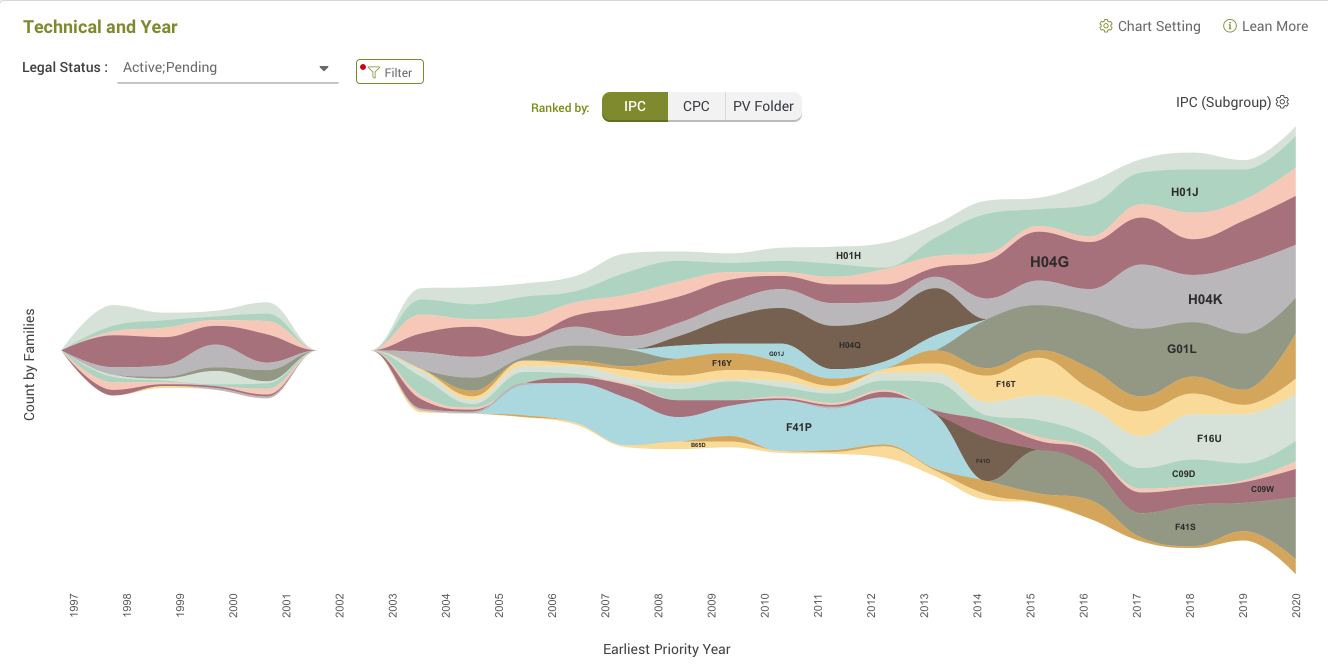

Technology

The technologies covered by the portfolio, extracted from the patents’ IPC or CPC subclasses, are visualized through bar or pie charts — what does the portfolio focus on?

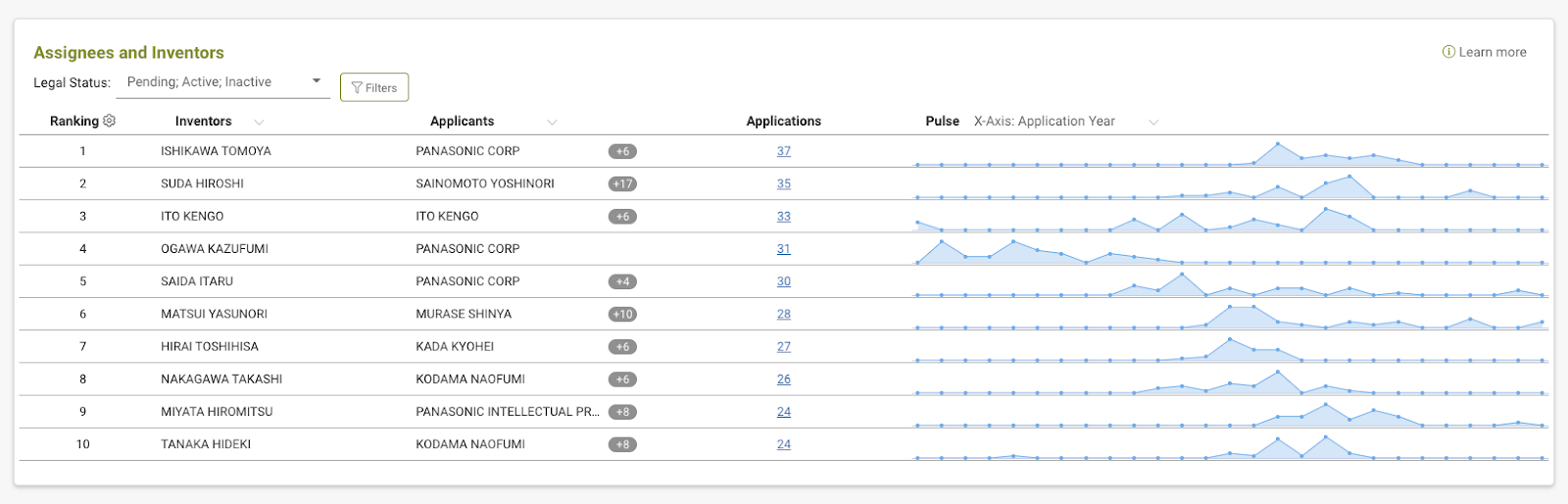

Owner/Inventor/Applicant

Patents with co-owners, co-applicants, or rights transferred to different owners may limit future enforcement. Don’t miss out on this vital information — will I have issues licensing the portfolio?

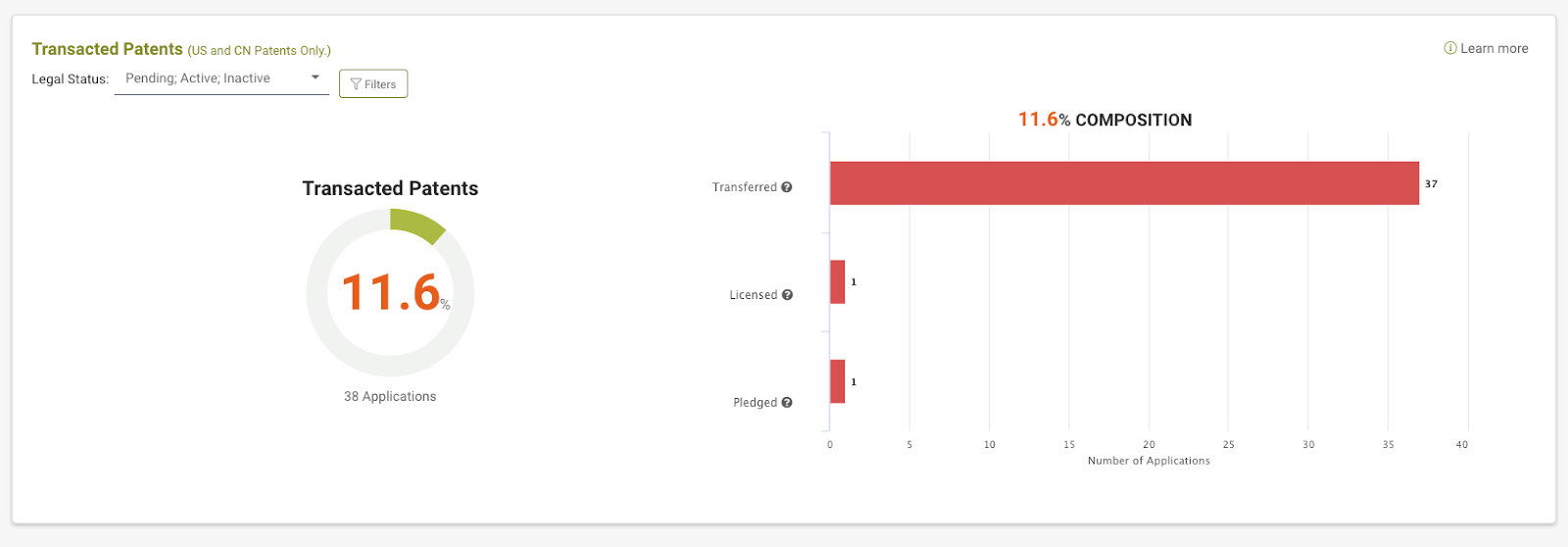

Historical Highlights

Take a closer look at the patents that have been transferred, licensed, or pledged, as well as those involved in patent infringement lawsuits, ITC Section 337 investigations, or challenged for their validity in USPTO PTAB cases — how did the portfolio perform previously?

Uncover hidden gems.

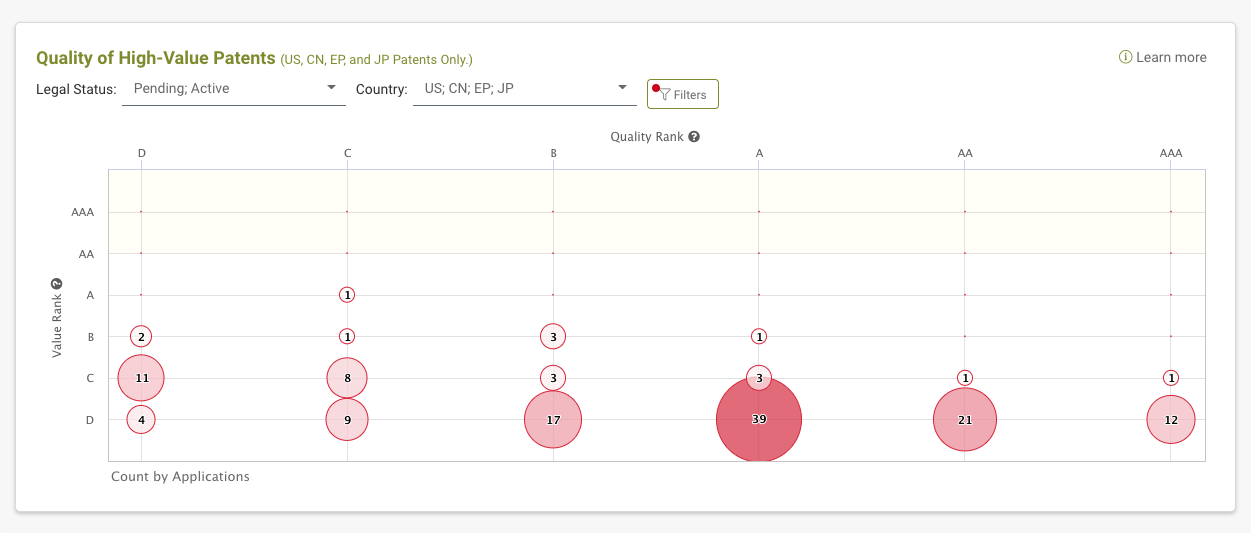

Quality and value metrics such as the Quality and Value Rankings — a Patentcloud exclusive—bring objectivity to patent evaluation.

Quality and Value

Remove the subjectivity that characterizes traditional patent evaluation indexes: Due Diligence relies on AI algorithms to evaluate the quality and value of patents.

Quality Highlights

Abandoned patent families and references cited by the examiners are an excellent first step towards finding prior art: find them all listed here without needing to sift through file wrappers.

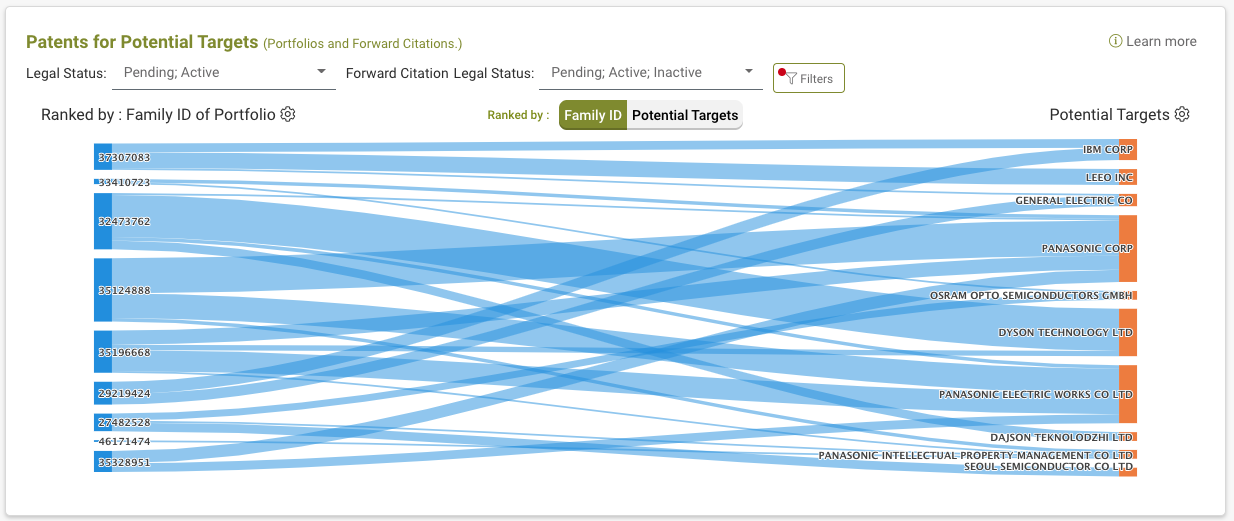

Value Highlights

Will this portfolio strengthen my position in the market? Due Diligence tells you exactly which companies you can target with the portfolio. For more accurate results, we not only look at forward citations but also the filing trends.

Under the hood.

Due Diligence’s dashboards aren’t only meaningful, but also extractive and pointful. Here’s what’s behind them.

100+

Global patent and non-patent databases

79m+

Global patent bibliographic data

100%

USPTO file wrapper completeness

98%+

US patent prior art extraction

Simply effective, without exception.

Patent monetization

Patent buying and selling

Patent licensing

Patent pledging

Investment and M&A

Venture capital and private equity

Investment banks

CPA firms and law firms

Patent portfolio analysis

Patent portfolio management departments

Get started with Patentcloud today

Discover how Patentcloud’s solutions and tools can work for you.

InQuartik Corporation, as the administrator of this website, uses browser cookies to track your session to provide you with a better experience.

You may opt out of all cookies that are not essential to the administration or maintenance of this website.

You may refer to our Privacy and Cookie Policy for more details. Please note that, by accessing our website, you agree to our Privacy and Cookie Policy.

Privacy Overview

| Cookie | Duration | Description |

|---|---|---|

| __hssrc | session | This cookie is set by Hubspot. According to their documentation, whenever HubSpot changes the session cookie, this cookie is also set to determine if the visitor has restarted their browser. If this cookie does not exist when HubSpot manages cookies, it is considered a new session. |

| _GRECAPTCHA | 5 months 27 days | This cookie is set by Google. In addition to certain standard Google cookies, reCAPTCHA sets a necessary cookie (_GRECAPTCHA) when executed for the purpose of providing its risk analysis. |

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| JSESSIONID | session | Used by sites written in JSP. General purpose platform session cookies that are used to maintain users' state across page requests. |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| __hssc | 30 minutes | This cookie is set by HubSpot. The purpose of the cookie is to keep track of sessions. This is used to determine if HubSpot should increment the session number and timestamps in the __hstc cookie. It contains the domain, viewCount (increments each pageView in a session), and session start timestamp. |

| __hstc | 1 year 24 days | This cookie is set by Hubspot and is used for tracking visitors. It contains the domain, utk, initial timestamp (first visit), last timestamp (last visit), current timestamp (this visit), and session number (increments for each subsequent session). |

| _ga | 2 years | This cookie is installed by Google Analytics. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. |

| _ga_GTLMQEG9VF | 2 years | This cookie is installed by Google Analytics. |

| _gat_UA-44688053-5 | 1 minute | This is a pattern type cookie set by Google Analytics, where the pattern element on the name contains the unique identity number of the account or website it relates to. It appears to be a variation of the _gat cookie which is used to limit the amount of data recorded by Google on high traffic volume websites. |

| _gat_UA-44688053-8 | 1 minute | This is a pattern type cookie set by Google Analytics, where the pattern element on the name contains the unique identity number of the account or website it relates to. It appears to be a variation of the _gat cookie which is used to limit the amount of data recorded by Google on high traffic volume websites. |

| _gcl_au | 3 months | This cookie is used by Google Analytics to understand user interaction with the website. |

| _gid | 1 day | This cookie is installed by Google Analytics. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the website is doing. The data collected including the number visitors, the source where they have come from, and the pages visted in an anonymous form. |

| fs_uid | 1 year | This cookie is set by the provider Fullstory. This cookie is used for session tracking. |

| hubspotutk | 1 year 24 days | This cookie is used by HubSpot to keep track of the visitors to the website. This cookie is passed to Hubspot on form submission and used when deduplicating contacts. |

| Cookie | Duration | Description |

|---|---|---|

| _fbp | 3 months | This cookie is set by Facebook to deliver advertisement when they are on Facebook or a digital platform powered by Facebook advertising after visiting this website. |

| fr | 3 months | The cookie is set by Facebook to show relevant advertisments to the users and measure and improve the advertisements. The cookie also tracks the behavior of the user across the web on sites that have Facebook pixel or Facebook social plugin. |