Patent investment can often prove to be a very intricate and complicated business. As a patent owner, how do you begin to put an initial price on a patent? How can you quantify and justify a patent’s monetary value when preparing a portfolio or a single patent for a potential future transaction?

On the flip side, as a patent investor, how do you comprehend which patents or patent portfolios are worth investing in? How do you begin to perform risk management and due diligence checks on a patent portfolio before making parting with your money and investing in something which is, when push comes to shove, an intangible asset? How cautious should you be?

As you can see, having only just scratched the surface, you can already begin to understand that there are many questions that both patent owners and patent investors need to ask themselves before even considering how and when to take the next step into the realm of patent investment.

In our upcoming series of insightful white papers, we will discuss the following:

- What is Patent Lifecycle Management?

- Operations in Different Stages of the Patent Lifecycle

- How to Use Big Data to Make Data-Driven Decisions

- How to Use Big Data to Support Your Operations

Before the release of our next series of white papers, we would like to take a brief look at the traditional approach to patent investment before offering our insight into the logic behind why we should be rethinking patent investment strategies.

Moreover, our series of white papers will also highlight why and how Artificial Intelligence and Big Data are paving the way for a more productive and effective method of preparing for and executing patent investment and managing patents during the various stages of their lifecycle.

The Traditional Patent Valuation Process

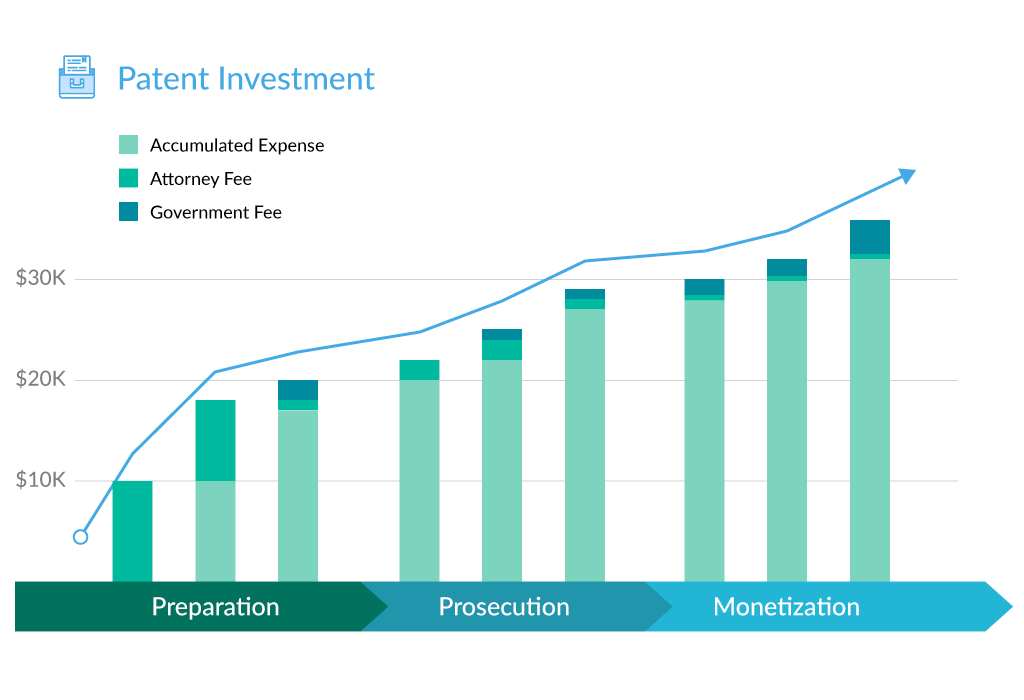

First and foremost, before a patent can be bought or sold, the monetary value must be placed. The patent valuation process is typically split up into three separate stages — the diligence stage, the analysis stage, and the reporting stage.

Traditionally, each step of the patent valuation process is completed manually. As you can imagine, manually performing due diligence checks, performing analysis, and then reporting on your findings and conclusions can be time-consuming and often inefficient.

Diligence Stage

Conducting due diligence checks on a patent or portfolio should be viewed as one of the primary stages of the patent valuation process before investment or transaction. This legal exercise should be carried out to ascertain the actual value of the assets (in this case, patents.)

More often than not, comprehensive information is not always readily available. Still, it should at least include documentation that highlights the value of the patent(s) and how much value the patent(s) will hold for the remaining duration of their life. This documentation typically includes (but is not limited to) the following:

- Limitations of the patent(s)

- Any licensing agreements

- Previous costs associated with the patent(s)

- Technical information

- Legal information

- Business information

Analysis Stage

The income-based, cost-based, option-based, and market-based methods are the four most commonly used approaches when contemplating patent valuation. The general consensus is that adopting multiple strategies is favored over a single method.

Reporting Stage

The closing stage in traditional, manual patent evaluation is to report on the findings, conclusions, theories, and work completed during the patent valuation process.

Mindset Shift

As you can see, manually preparing for patent investment takes a lot of time and effort. AI and Big Data can support mindful and effective decision-making.

As mentioned earlier, our upcoming series of white papers will shed some light on how and why big data and AI can support and optimize patent investment and patent lifecycle management throughout all stages of the patent’s life.

When rethinking patent investment, we must consider the following:

- Are patents assets or debts?

- Is patent management just a continuous investment process?

- Can the continuous accumulation of big data help to shape patent assets?

Patents are assets, and they are classed as being valuable. However, since patents are not tangible, in accounting, they are often referred to as “intangible assets.”

The nature of patent management is no different from that of a tangible asset such as a car. One wouldn’t typically invest in a car after buying it but would, however, pay a maintenance fee (of sorts.)

You will only maintain a patent after it has been granted (when you have the rights.) Therefore, patent management is a continuous investment process if, and only if, asset management is a continuous investment process.

For practicing entities, innovation (R&D) asset management should be a continuous investment process (because it is at the core of the business.) Patent management transforms part of the innovation output into intangible assets and maintains them.

When it comes to managing the respective patent(s), again, it is like the car or any other tangible assets. The difference is that the quality and value of such intangible assets are unstable (unlike a tangible asset such as a car.)

The shaping of patent assets is similar to the concept of industry 4.0; the prosecution of a patent is just like the manufacture of a car.

Therefore, in theory, the shaping of patent assets supported by the continuous accumulation of big data is similar to the idea of industry 4.0, which also supports the manufacture of products utilizing the accumulation of big data.

What’s Next?

In our upcoming series of white papers, we will provide in-depth insight into patent lifecycle management. In particular:

- Uncovering technological development insights

- Optimizing budgeting and resource allocation

- Enhancing the quality and value of patent portfolios

- Minimizing unnecessary patent investment

- Maximizing the ROI of patent assets