The 5G SEP landscape in 2023 saw Ericsson, Vivo, OPPO, Lenovo, and Apple leading in declarations, possibly driven by their involvement in licensing disputes. Ericsson and Qualcomm emerged as top active declarers among licensors. Despite the increase in declarations, a comparative analysis indicates no significant compromise in essentiality or quality, particularly for Ericsson and OPPO. For Apple, Vivo, and Lenovo, conclusions about their SEP quality remain tentative, pending further examination.

Table of Contents

- Introduction: Heightened Monetization and Licensing Dynamics in 2023’s 5G SEP Landscape

- 2023 Review: Comprehensive Analysis of the Year-End 5G SEP Landscape

- 2023 Review: Key Dynamics in the 5G SEP Landscape

- In-Depth Analysis: OPPO Maintains Quality, Vivo and Lenovo Under Review

- Conclusion: Navigating Challenges and Innovations in 2023’s 5G SEP Arena

Introduction: Heightened Monetization and Licensing Dynamics in 2023’s 5G SEP Landscape

2023 marked a pivotal year for 5G Standard Essential Patents (SEPs), characterized by increased monetization and intensified licensing activities. Key industry players like Ericsson, Nokia, InterDigital, and Huawei actively pursued licensing revenues and engaged in significant legal confrontations, reshaping the market’s strategic landscape. Notably, the protracted patent dispute between OPPO and Nokia not only stirred the European mobile market such as the UK but also brought into sharp focus the aspects of FRAND and global FRAND rate, which is heavily related to essentiality and patent quality. The year also saw Vivo recalibrating its strategy in Germany following judicial setbacks, Huawei announcing its royalty standards, and Avanci introducing a specialized licensing program for 5G connected vehicles. Ericsson’s resolution of its licensing dispute with Apple at the end of the previous year set a precedent for subsequent agreements with Huawei and Xiaomi, indicating a shift towards more assertive licensing postures. These developments underline the growing emphasis on SEP essentiality and quality, setting the stage for a closer examination of the 2023 5G SEP landscape, which will be explored in the following sections.

2023 Review: Comprehensive Analysis of the Year-End 5G SEP Landscape

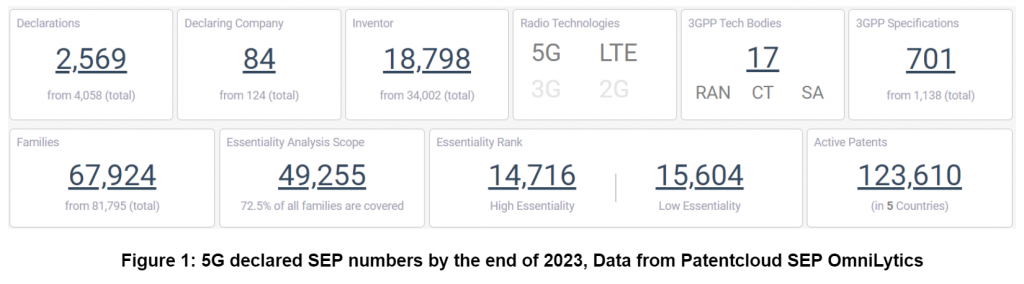

The year 2023 was a significant one for the 5G Standard Essential Patents (SEPs), marked by a flurry of activities and strategic declarations. A total of 84 companies actively participated in the SEP landscape, making 2,569 declarations post-Release 15. These encompassed a diverse array of patents, both Standalone and LTE-related, highlighting the expansive nature of the 5G technology.

The landscape was further detailed by 67,924 Extended families of patents, which were actively applied for or held valid in key markets such as the US, EP (including Germany), China, WIPO, and the emerging Indian market. A significant portion of these patents, amounting to 62,888 or roughly 92.6%, were dedicated to Radio Technology related to 5G New Radio (NR), demonstrating the heavy emphasis on advancing 5G core technologies. The remainder were largely attributed to the TS 36 series LTE-related patents, showcasing the ongoing relevance and evolution of LTE in the 5G era.

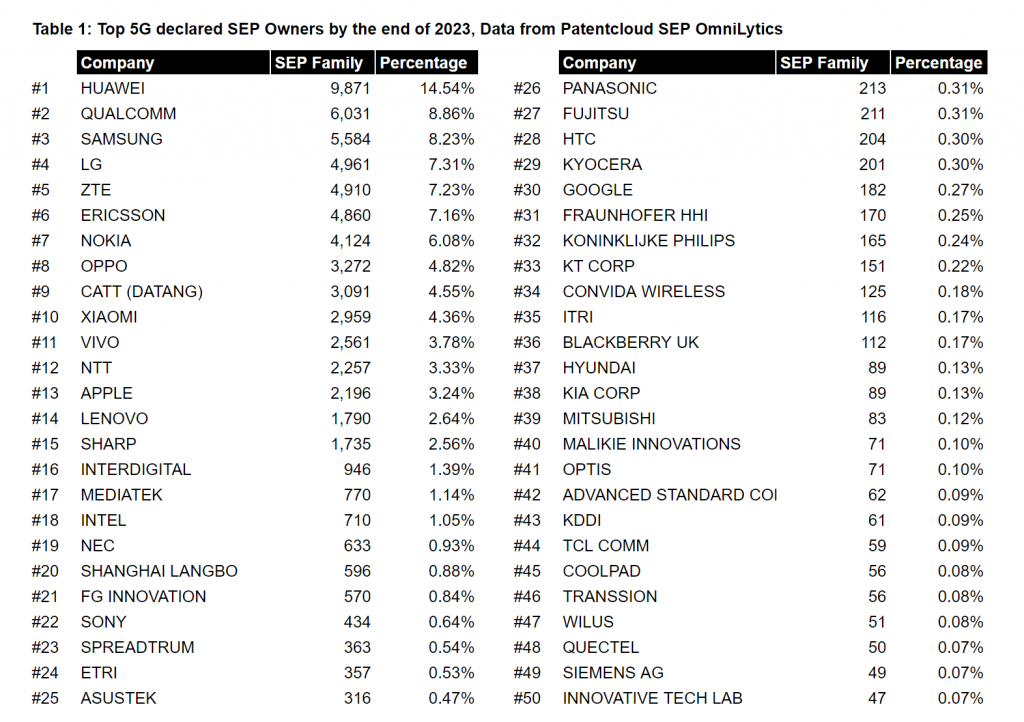

The distribution of these patents was notable, with over 300 patent holders involved. However, a staggering 99% of the patent families were controlled by the top 50 companies, underscoring the concentration of 5G SEP ownership among leading industry players.

Regionally, the landscape presented nuanced variations. In the US, the Top 15 rankings saw a shift with companies like Apple, Ericsson, Nokia, and NTT holding prominent positions, reflecting a diverse and competitive environment. In contrast, the Chinese market depicted an opposite trend in its Top 15, while Europe and India maintained a consistent pattern with their overall global standings, barring Qualcomm’s notable position in the Indian market.

2023 Review: Key Dynamics in the 5G SEP Landscape

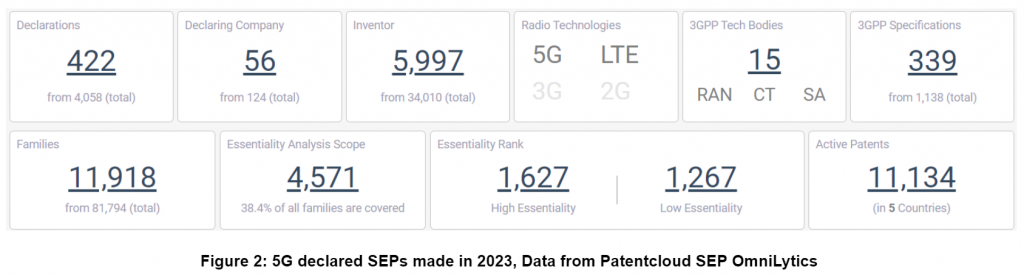

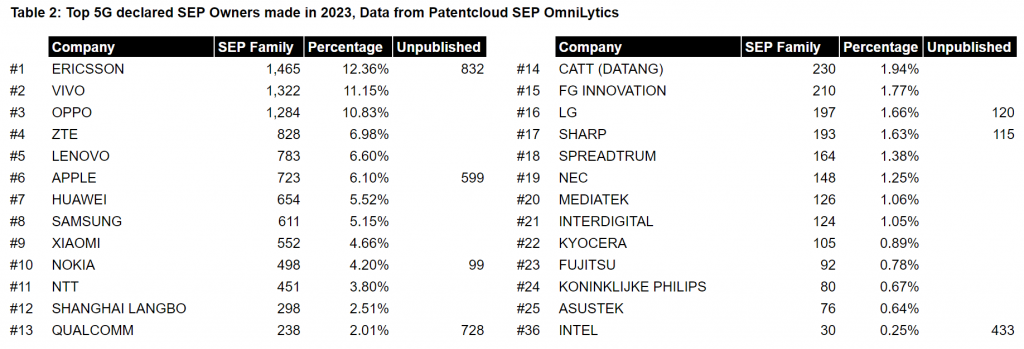

In 2023, based on published patent information, the 5G SEP market was marked by a significant shift, with 50% of SEP declarations coming from Chinese companies, notably Vivo, OPPO, and Lenovo. Despite patent disclosure limitations due to an 18-month confidentiality period, 56 companies made 422 declarations involving 11,918 families, accounting for 15.7% of the landscape. Notably, 9,062 of these families were newly declared, constituting 13.3% of the total. The declarations spanned across key regions, including 8,531 in the US, 9,220 in China, and 5,813 in Europe.

The 2023 SEP declarations were held by over 100 companies, with the top 25 owning over 95%. Ericsson, Vivo, OPPO, Apple, Lenovo, and Shanghai Langbo were prominent among these, making substantial new declarations. This trend, particularly among companies like Vivo, OPPO, Apple, and Lenovo, reflects a strategic shift in response to recent SEP disputes, indicating an effort to strengthen their market positions.

When it comes to also include declared SEP which are not yet published, additional 2,952 applications are declared by 10 companies, especially Ericsson, Qualcomm, Apple and Intel. Regarding unpublished declared SEPs, approximately 66% are US provisional, with an additional 2,954 applications predominantly declared by Ericsson, Qualcomm, Apple, and Intel. This shifts the conclusion of the 2023 momentum analysis, unveiling previously unrecognized momentum from Qualcomm and Intel.

In-depth technology analysis of the new SEPs from Vivo, OPPO, and Lenovo, conducted using InQuartik’s AI-powered Patent Summary, revealed their focus on advanced communication technologies:

- Vivo declared 1,322 families, focusing on technologies such as Network optimization and efficiency, Channel measurement and synchronization, Uplink transmission, Wireless networking and multicast systems, Transmission protocols, Resource management and allocation, Channel state information (CSI) reporting, channel monitoring and control, Random access, and Beam failure detection and recovery.

- OPPO declared 1,284 families, primarily involving Wireless network management and handover, Wireless data channel management, Uplink feedback, Wireless protocol efficiency and relay coordination, Signal synchronization and carrier management, Paging, Random access, Discontinuous reception, and Sidelink data transmission.

- Lenovo’s declarations included 783 families, mainly encompassing Uplink transmission, Wireless handover, Connectivity management, Authentication and key management, Sidelink communication, Route selection, Channel state information (CSI) reporting, Sidelink positioning, Beam management and failure recovery in sidelink, and HARQ feedback codebook configuration.

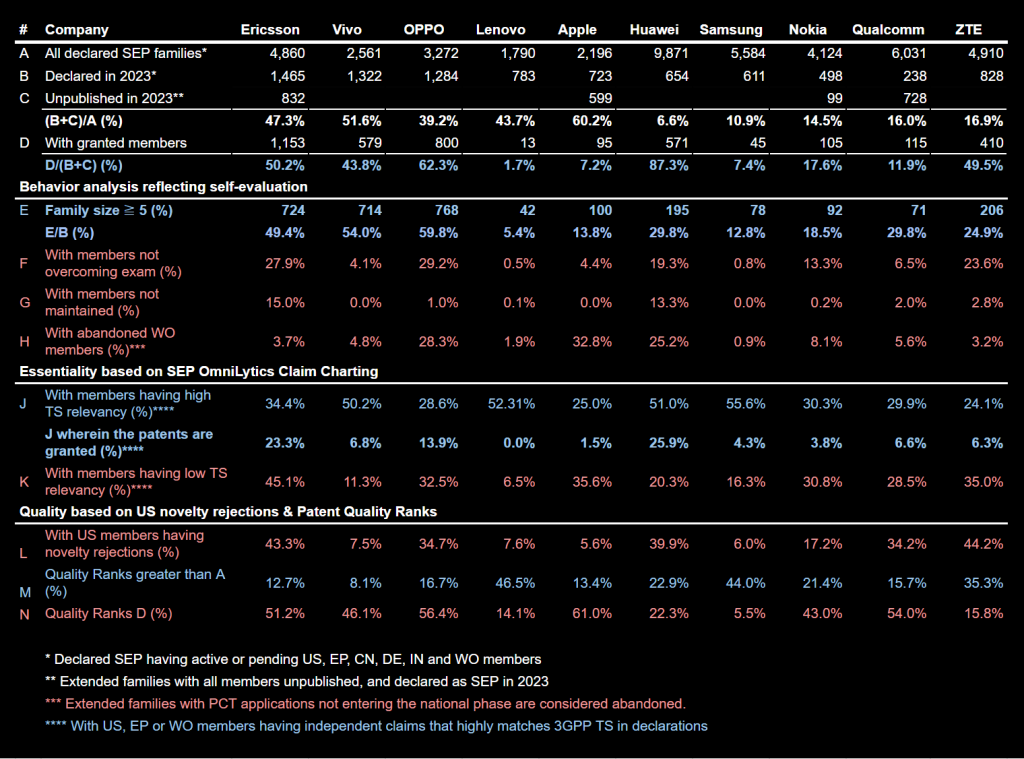

This surge in patent declarations prompts a consideration of quality. A comparative quality analysis among rapid declaration-growing companies like Ericsson, Apple, Vivo, OPPO, and Lenovo, and other top declared SEP owners such as Huawei, Samsung, Nokia, Qualcomm, and ZTE, is essential to understand the implications of this rapid expansion on patent quality.

In-Depth Analysis: OPPO Maintains Quality, Vivo and Lenovo Under Review

Using data from the Patentcloud platform, the analysis includes:

- Behavioral Analysis: The number of families a company commits to file extensively (in at least 5 markets) after evaluating their essentiality and market viability, the percentage of families abandoned due to maintenance fee decisions or not entering national phases in PCT applications, and the percentage of applications dropped due to patentability challenges during the review process.

- Essentiality Analysis: Utilizing Patentcloud SEP OmniLytics to match declared TS with independent claims, focusing on patents in the US, Europe, or PCT applications with English claims.

- Quality Analysis: The proportion of a company’s US patent families encountering novelty prior art during reviews, and a Quality Rank predicting future patent examination success or third-party challenge resilience based on deep learning.

Table 3: Comparisons between top declared SEP owners for quality review, Data from Patentcloud

From the analysis, rapid declaration-growing companies, including Ericsson, Vivo, and OPPO, showed no significant weakness in behavioral, essentiality, and quality analysis compared to the control group. In fact, these companies demonstrated a notably higher proportion of extensive patent portfolios.

Specifically, Ericsson and OPPO stood out with a higher ratio of granted and essential patents. While other major rights holders, such as Vivo and Apple, also showed a substantial portion of patents with high essentiality, their performance in patent examination, especially in the US where novelty prior art often necessitates claim adjustment, remains to be thoroughly reviewed, especially Apple, still having 599 US provisional applications to be developed into regular applications. Lenovo, on the other hand, exhibited a lower rate of extensive layout, with most patents still in the PCT international application stage and not yet in national phases.

In summary, companies like Ericsson, Vivo, OPPO, Lenovo, and Apple, which made numerous declarations in 2023, did not exhibit a significant sacrifice in quality compared to the control group. However, a detailed look reveals that OPPO has a higher proportion of families passing patent examinations, while Lenovo’s future investment in SEP portfolio development and quality after examination are pending further confirmation over time.

Additionally noteworthy, despite not having a high overall proportion, Chinese companies Huawei and ZTE maintained leading positions in the 2023 declared SEP family rankings. Their extensive layouts even surpassed other patent rights holders. Huawei’s profile was similar to Ericsson’s, with most patents granted and over 20% highly relevant to TS (Technical Specifications). Both being rights holders, Ericsson’s number of declared SEP families in 2023 was twice that of Huawei, but Huawei’s overall patent count remained double that of Ericsson. This might explain Ericsson’s strategy of making numerous declarations to assert its position for more favorable licensing negotiations. Qualcomm also declared numerous 5G SEP in 2023 to strengthen its 5G SEP position which was also announced in early 2023. However, most of its declared SEPs are not yet published for further insights. In contrast, Nokia, another member of the control group actively involved in litigation and licensing in 2022 and 2023, displayed organic growth with most of its declared patents still under review.

Conclusion: Navigating Challenges and Innovations in 2023’s 5G SEP Arena

2023 was a pivotal year for the 5G SEP market, marked by significant strategic adjustments and responses. Companies like Ericsson, Nokia, InterDigital, and Huawei initiated licensing fees and lawsuits, prompting others, including Vivo, OPPO, Lenovo, and Apple, to strengthen their patent portfolios. This demonstrated their rapid adaptation to market changes, despite their relative weakness in the global arena.

Ericsson and Qualcomm, as major licensors, significantly declared new 5G SEPs in 2023, seemingly to gain an advantage in future negotiations.

When assessing these companies’ patent portfolio development, patent quality and essentiality were crucial. The comprehensive comparison across behavioral, essentiality, and quality aspects showed that while expanding their SEP portfolios and making numerous declarations, these companies did not significantly compromise on quality or essentiality. Notably, most patents from Ericsson and OPPO have already passed examination. Others like Vivo and Lenovo, though not significantly lagging behind the control group, still have most of their declared SEPs under review, requiring further observation.

The dynamics of 2023 reflect the intensive efforts of several companies to address their shortcomings in the face of competition. This response and adjustment, while not leading the trend, are crucial, especially as many declared SEP families are still under review. These developments, though not too late, still hold the potential to influence the landscape for future 5G, Beyond 5G (B5G), and even 6G SEPs.

For inquiries or to explore the data behind this review, please Contact Us. Interested in a free trial of SEP OmniLytics? Get in touch today!