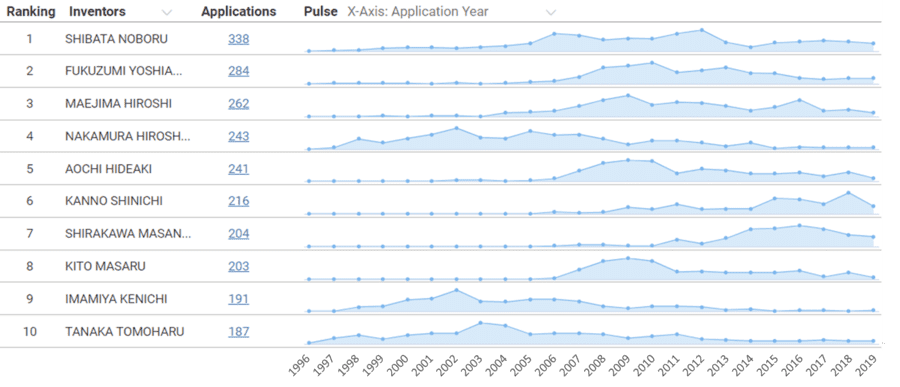

Top 10 Inventors

When merging or acquiring a company, besides transferring patents, investors should also ensure that key inventors can be transferred to a post-M&A (mergers and acquisitions) company. The key inventors are essential to maintaining the capabilities of innovation and development for the post-M&A company.

If the post-M&A company acquires patents without the key inventors, the investor should evaluate whether the innovation and development capabilities of the target company will remain unaffected after the M&A.

As for the sale of Toshiba Memory, since the patents involved could have been transferred between entities with no issues, the inventors had the option to decide whether or not they wanted to work for a new company. In past M&A cases, post-M&A companies lost some of their key inventors, leading to unexpected losses for the investors.

The authors analyzed Toshiba Memory’s inventors to discuss whether such a situation also occurred during the sale of Toshiba Memory.

As discussed above, Toshiba Memory had roughly 7,500 patent families, including over 18,000 patents in 18 patent offices around the world. The top five patent offices of Toshiba Memory patents were the USPTO (the United States Patent and Trademark Office), the JPO (Japan Patent Office), the TIPO (the Taiwan Intellectual Property Office), the CNIPA (China National Intellectual Property Administration), and the KIPO (Korean Intellectual Property Office). The US patents made up the bulk of the Toshiba Memory patents, far outnumbering the JP patents.

Since the Toshiba Memory patents included far too many inventors (over 2,000) to be analyzed one by one, the authors used the one-click solution provided by Patentcloud‘s Due Diligence. This solution allows the readers to quickly understand more about the top 10 inventors and the filing year distribution of the Toshiba Memory patents.

The above figure shows the top ten inventors of Toshiba Memory patents, including SHIBATA NOBORU, FUKUZUMI YOSHIAKI, MAEJIMA HIROSHI, to name but a few.

Among the top ten inventors, there were three inventors (NAKAMURA HIROSHI, IMAMIYA KENICHI, and TANAKA TOMOHARU) who filed patents mostly in the earlier filing years, and decreased their patent filing activities afterward.

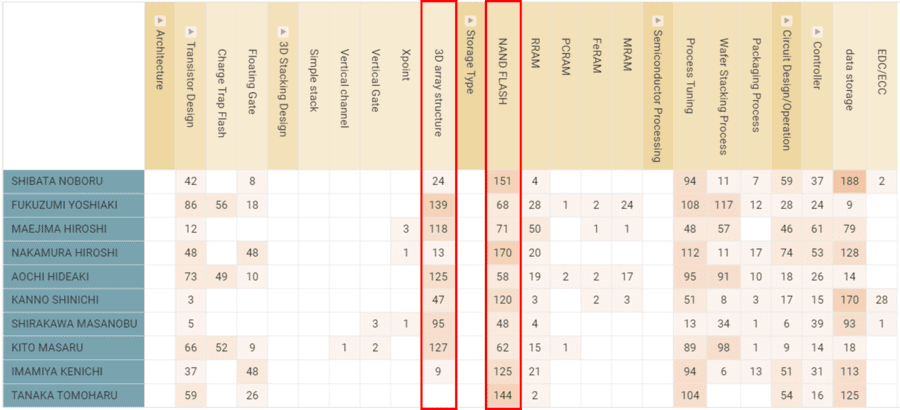

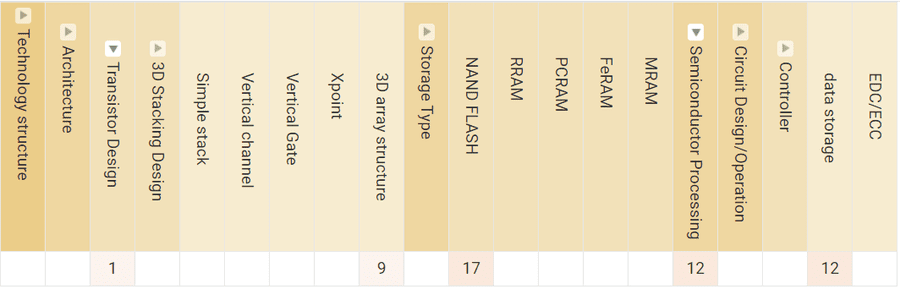

The technology distribution of the top ten inventors shows that in NAND flash technology, the most significant inventors were NAKAMURA HIROSHI, SHIBATA NOBORU, and TANAKA TOMOHARU; in 3D array structure technology, the major inventors were FUKUZUMI YOSHIAKI, KITO MASARU, and AOCHI HIDEAKI.

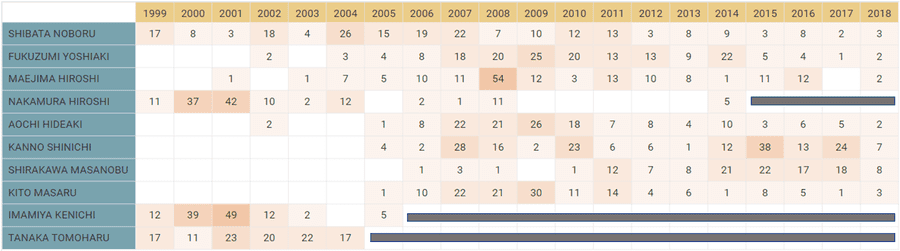

The above figure shows the priority year distribution of the top ten inventors of Toshiba Memory patents.

After an inventor leaves a company, the company can file continuation patent applications based on the inventor’s previous patents filed while they still served in the company. Therefore, the authors used the patent priority year analysis to trace back to the earliest filing year of each patent. Although all of the top ten inventors filed US patents in 2018, only seven of them filed new patents in 2018 (after the TMC spin-off) as the distribution of patent priority years shows.

The authors suspected that the seven inventors might still be employed by, or may have another service relationship with TMC. The other three inventors from the top ten, NAKAMURA HIROSHI, IMAMIYA KENICHI, and TANAKA TOMOHARU, filed no new patents in 2018. Among the three inventors, NAKAMURA HIROSHI and IMAMIYA KENICHI both filed more than 100 US patents in NAND flash technology, which means that they were key inventors in this technology. However, they did not file any new patents under the assignee Toshiba for more than ten years. From the perspective of investment estimates, the current situation of NAKAMURA HIROSHI and IMAMIYA KENICHI needs to be investigated further.

The authors further analyzed inventor TANAKA TOMOHARU’s patent filing history. The authors found that TANAKA TOMOHARU had filed several patents under the assignees of Micron and Intel.

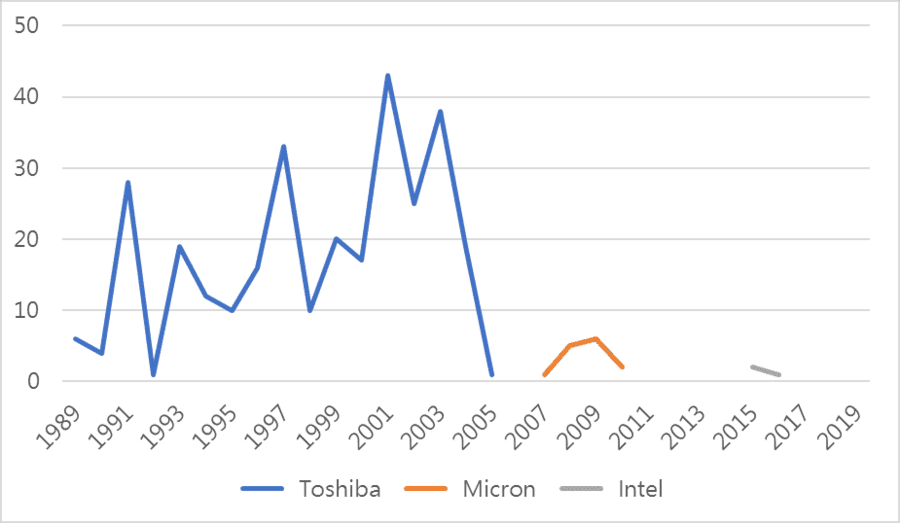

The above figure shows the priority year and assignee distribution of inventor TANAKA TOMOHARU’s US patent filing history. There were three assignees in TANAKA TOMOHARU’s US patent filing history, Toshiba (some patents co-owned with SanDisk), Micron, and Intel.

Regarding the priority year distribution, it was apparent that TANAKA TOMOHARU was a very senior member of Toshiba Memory’s research team, with the earliest patent filing going back to 1989. However, TANAKA TOMOHARU had not filed any new patents under the assignee Toshiba since 2005. TANAKA TOMOHARU began filing new patents under the assignee of Micron and Intel from 2007; it is suspected that TANAKA TOMOHARU commenced employment or engaged in another service relationship with Micron and Intel in 2007.

The US patents of TANAKA TOMOHARU—filed under the assignees Micron and Intel—were also related to NAND flash technology. Micron and Intel were Toshiba Memory’s competitors in the NAND flash product market, holding the top fourth and fifth market share rankings, respectively.

From the above analysis, the authors established that the top ten inventors of Toshiba Memory stopped filing new patents. One of the inventors later commenced employment or engaged in another service relationship with the competitors of Toshiba Memory and went on to file new NAND flash technology patents.

By analyzing the Toshiba Memory case, the authors would like to remind investors to perform patent due diligence before merging or acquiring a company. In light of the development of artificial intelligence, combined with big data, investors may use a one-click solution such as Patentcloud‘s Due Diligence to save a significant amount of time when compared to conventional analysis. Such solutions can also provide valuable information about the key inventors of a target company in seconds.

After such analysis, investors can then make arrangements to interview the inventors to confirm their current situation and future plans. If any of the inventors plan to leave the company, the investor can then proceed to ask the target company to evaluate whether the technology and resources developed by the inventors are fully controlled by the company, to assure that the research and development of the company remain unaffected.

Additionally, after reviewing the various situations of the inventors involved, the investors can then decide on the right strategies for the post-M&A integration process in order to strengthen the research and development capabilities and competitiveness of the company.

Summary

Whether or not any given M&A activities result in success depends on various factors. Many investors tend to solely focus on evaluating the business and technology capabilities of a target company. By analyzing the global deployment, patent quality and value, and the top ten inventors of TMC’s patents, the authors were able to evaluate the potential risks involved in the acquisition of Toshiba Memory. Such analysis can also enable investors to get a deeper understanding of a target company before making any M&A decisions, thus avoiding future risks by reducing information asymmetry.

In addition to the above, a complete patent due diligence analysis should also include a thorough patent portfolio, patent litigation, competitive intelligence, and alternative technology analysis. Following the acquisition process, a complete patent due diligence check can also help investors to make plans for resource integration and allocation, along with patent monetization, such as choosing the patents of specific technologies for licensing or transaction purposes.

Got a patent portfolio to analyze?

Sign up to conduct your own due diligence analysis today with the same tools the authors used in this article!

Authors: Jean Chou, Steven Chang, and Bace Tseng (Wispro Technology Consulting Corp.)