Following on from the first part of the Toshiba Memory (Kioxia) Patent Deployment Analysis, the authors will further analyze the technology distribution of TMC’s patents and their patent quality and value.

When Toshiba decided to sell TMC, several groups joined the bidding process. This bidding process was full of twists and turns, and the likely winner of the bid was not clear until the very last moment. In September 2017, TMC was eventually sold to the US-Japan-South Korea Alliance—led by the US investment company Bain Capital—as mentioned in our previous article.

The owner of SanDisk—Western Digital—also joined the bid. Before being acquired by Western Digital, SanDisk was the only fabless supplier of flash memory, and it had many flash memory patents. Toshiba was an OEM partner of SanDisk’s flash memory business, Toshiba also licensed all of its memory patents to SanDisk, including the patents that had been transferred to TMC. Since Toshiba and SanDisk collaborated on many business-related projects, including investments related to memory foundries and the R&D for 3D NAND flash, Western Digital tried to stop TMC from being sold to other bidders via various legal avenues. Although Western Digital was initially considered to be the winner, it eventually lost the bid due to price issues.

One might wonder how the ownership of patents was assigned to Toshiba and SanDisk if they were collaborating on R&D, manufacturing, and patent licensing activities. One might also wonder whether the patents transferred to TMC from Toshiba could allow TMC to become fully independent in both R&D and patent issuance. As discussed above, the US patents make up the highest percentage of TMC’s total number of patents.

The 8000 US patents account for roughly 50% of the total amount. The Japanese and Chinese patents are the second and third largest, respectively. The authors analyzed their quality and value along with the technology distribution.

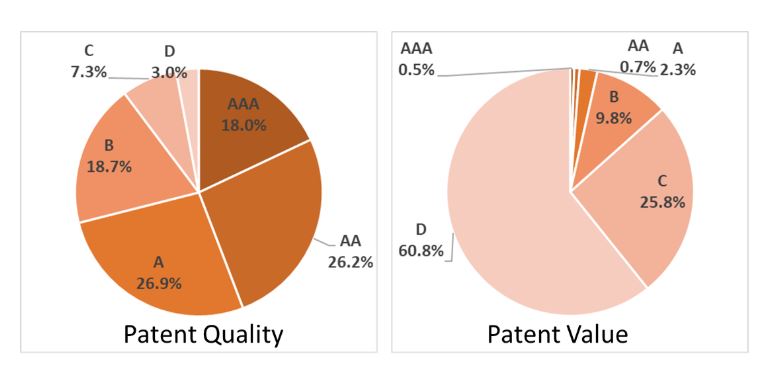

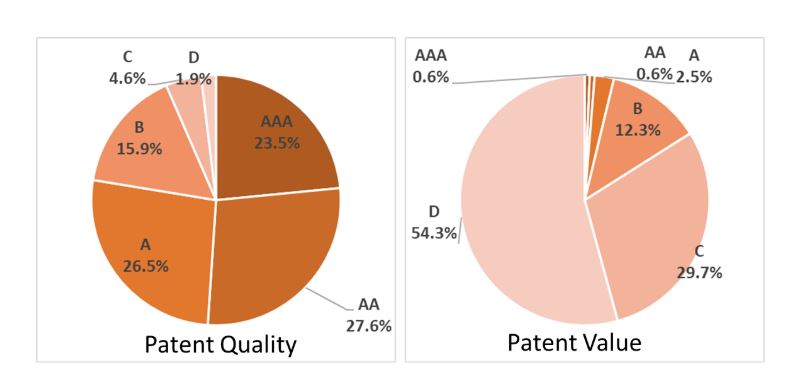

Patentcloud’s Patent Quality Rankings indicate the relative eventuality of prior art references being found for a patent. Findings such as these could then potentially threaten the patent’s validity. The Patent Quality Rankings consider factors such as the qualifications and profile of the attorney and examiner, number of potential prior art references, and the structures of both the independent and dependent claims.

Patentcloud’s Value Rankings focus on reflecting the relative tendency of a patent to be practiced or monetized after its issuance. The value rankings consider factors including the qualifications and profile of the inventor and applicant, the stage of the technology life cycle, citations, pre-grant assignment, and licensing.

The above charts show that over 70% of TMC’s US patents’ Quality Rankings are A or above (i.e., A, AA, and AAA). In other words, most of TMC’s US patents have a relatively low chance of being threatened or challenged for their validity. It is evident that Toshiba Memory emphasizes its patent quality, and its patent drafting and prosecution processes are subject to stringent procedures. However, the Patent Value Rankings of TMC’s US patents are relatively low, with only 3.5% of its US patents holding a Patent Value Ranking above A. Such results are subject to scrutiny since TMC is a leading company in the memory market (especially NAND flash) and has a long research and development history.

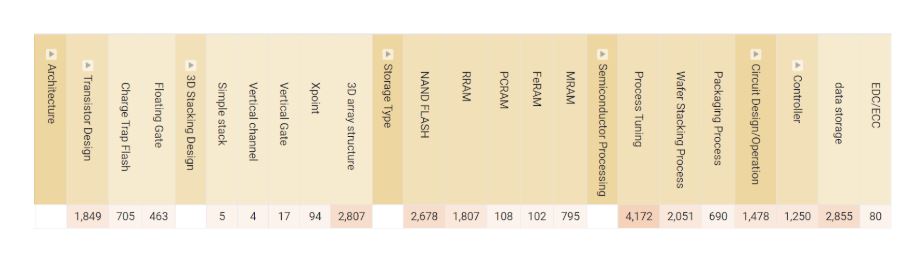

The above figure shows that among the different types of memory, TMC mainly focuses on NAND flash. This finding is reflected in its leading market position in NAND flash products. TMC also focuses on RRAM (Resistive Random-Access Memory) and MRAM (Magnetoresistive Random-Access Memory). In 3D stacking design, TMC focuses on the 3D array structure. It is worth noting that Intel and Micron published the Xpoint technology for 3D stacking design in 2015, and it was based on PCRAM (Phase Change Random-Access Memory) technology. Therefore, TMC uses a different 3D stacking design from that of Intel and Micron.

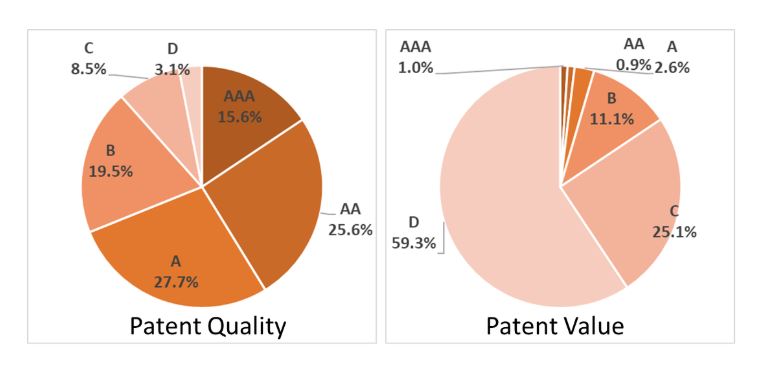

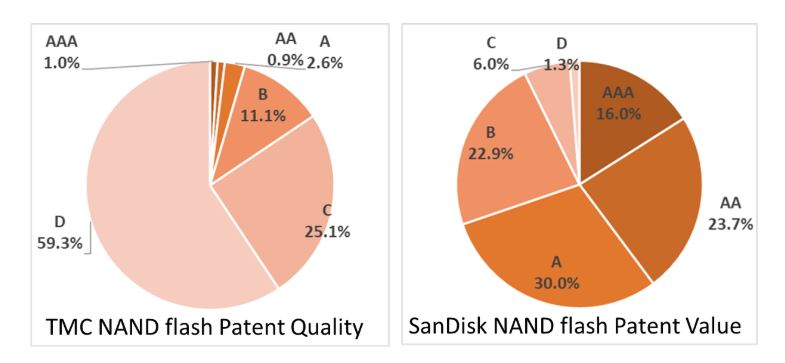

The authors further analyzed the Patent Quality and Value distribution of TMS’s US patents in NAND flash and 3D array structure—which are two of the major technologies of TMC’s US patents. The charts above show that more than 70% of TMC’s US patents in NAND flash technology and around 78% in 3D array structure have Quality Rankings of above A. The high-value US patents (above A) of the two technologies are both less than 5%. Such high-value patents should be around 25% in a typical distribution.

The authors used the same search query to search the NAND flash patents of SanDisk and further compared the Patent Value distribution of TMC and SanDisk. The results were fascinating. SanDisk’s US NAND flash patents are twice that of TMCs, and SanDisk has much higher Patent Value distribution—more than 70% of its US patents are above A in NAND flash technology—than TMC (4.5% of its US patents were above A).

The authors consulted with one of Patentcloud’s big data experts to establish possible causes of such a significant difference. The expert said that SanDisk’s patents might have been at an earlier stage of the technology life cycle. Additionally, SanDisk’s patents were cited more by other patents.

As discussed earlier, during the collaboration between Toshiba Memory and SanDisk, SanDisk was in charge of chip design and flash memory block management, while Toshiba Memory mainly focused on manufacturing. Such collaboration resulted in a different distribution of Patent Value. SanDisk, which mainly focused on innovation and R&D, had an earlier deployment of new technology and its application than Toshiba; therefore, SanDisk’s patents were at an earlier stage of the technology life cycle and had been cited more by other patents. Thus, the Patent Value distribution of SanDisk was higher than that of Toshiba Memory, which focused more on manufacturing.

The authors presumed that during the collaboration between Toshiba and SanDisk, SanDisk owned most of the high-value patents of NAND flash technology. Western Digital and Toshiba entered into a global settlement agreement to solve their disputes in 2017. If SanDisk’s NAND flash patents were not licensed to TMC, TMC might face future patent risks from SanDisk. The authors will continue to monitor the patent deployment of both SanDisk and TMC.

Currently, the combination of artificial intelligence and patent data analysis is becoming more sophisticated. Investors may use Patentcloud’s Quality and Value Rankings to quickly check on the Patent Quality and Value of a target company to save considerable amounts of time when compared to performing conventional analysis. By analyzing Patent Quality and Value, investors can promptly evaluate the competitiveness of the target company. They can then make more of an informed decision when it comes to their investment strategies.

Download our white paper Patent Lifecycle Management: What, Why, and How? to discover how the Patent Quality and Value Rankings work in detail.

Stay tuned for the final installment in the Toshiba Memory (Kioxia) patent deployment analysis where the authors analyze Toshiba Memory’s top ten inventors.

Authors: Jean Chou, Steven Chang, and Bace Tseng (Wispro Technology Consulting Corp.)