Litigation Cases Are Rising

According to a recent Bloomberg report, patent litigation cases are on the rise. The federal courts are witnessing an increase in patent infringement lawsuits, and recent IP sales also indicate that this trend is not stopping any time soon.

According to Bloomberg Law data, the patent-related lawsuits since January 2020 have increased by 9% (YOY). New cases from non-practicing entities, AKA patent trolls, are also contributing to the overall increase in patent infringement cases. Furthermore, the aftermath of the current COVID-19 pandemic is anticipated to add to the influx of new lawsuits, as struggling firms start looking to sell their patents off to create income.

It is apparent that both the Federal Circuit and the Patent Trial and Appeal Board (PTAB) are making it harder than ever for patent infringers to invalidate patents quickly. In the past, it was relatively easy to invalidate patents via the PTAB within approximately 12 months. Some patent owners protested this and, subsequently, the PTAB changed its attitude somewhat.

What’s more, some important U.S. Court of Appeals for the Federal Circuit (CAFC) decisions have since been made, which in some aspects will make it more difficult for the patents to be invalidated. Firstly there are some additional conditions related to the claim construction—such as consistency with the district court—instead of the broadest reasonable interpretation. Besides, the CAFC has also made a further decision that allows the patent owner to amend claims during the PTAB proceedings—upon meeting specific criteria.

A Noteworthy Patent Troll Case: Apple Inc vs. VirnetX Holding Corporation

In 2018, Apple Inc was ordered to pay the patent troll VirnetX $502.6m after an eight-year battle. In fact, the battle was still dragging on this year as Apple went to a U.S. appeals court in an attempt to persuade them to reconsider the split decision, this request was subsequently rejected.

How did this case come about? Here is an overview of the events that led to Apple being told to fork out over $500m to VirnetX: In Feb 2016 a US court ordered Apple to pay $625.6 million to VirnetX for infringing upon a number of its IP. The jury ruled in favor of VirnetX and agreed that Apple had indeed infringed upon communications protocol patents in the FaceTime, iMessage, and VPN on Demand services, along with the devices that utilize them.

It’s worth mentioning that this was the second time that VirnetX had successfully sued Apple for the use of the abovementioned intellectual property. VirnetX had already won an estimated $368 million from Apple in 2012, along with nearly securing a running royalty of 1% of all iPad and iPhone sales.

Apple was subsequently ordered to redesign FaceTime following the jury’s ruling—which was in favor of VirnetX. However, that verdict was later thrown out in 2014 when an appellate court declared that the previous judgment was “tainted.”

Apple filed for a mistrial a few days after the abovementioned judgment stating that VirnetX’s attorneys used “arguments outside the evidence and blatantly misrepresented the testimony of Apple’s witnesses,” according to Texas Lawyer.

In the third trial between the two companies, the jury ordered Apple to pay $302.4 million to VirnetX after it observed that the FaceTime feature did infringe upon VirnetX’s patents. The case will now go to the United States Court of Appeals for the Federal Circuit in Washington, DC. In 2017—five years after the initial lawsuit—Apple was then ordered to pay $439.7 million to VirnetX in a final judgment from the U.S. District Court. Apple stated that it would appeal against the ruling.

2018 saw the next twist in the tale, with Apple being ordered by a Texas federal court to pay $502.6 million to VirnetX. At the time of writing this article—after the rejection from the U.S. appeals court in 2020—it’s becoming more and more likely that this case will continue to drift through the courts. According to Apple Insider, the next stage will be determined by a Texas court, which may recalculate how much Apple should pay to VirnetX. Apparently, there’s even a chance of a complete retrial.

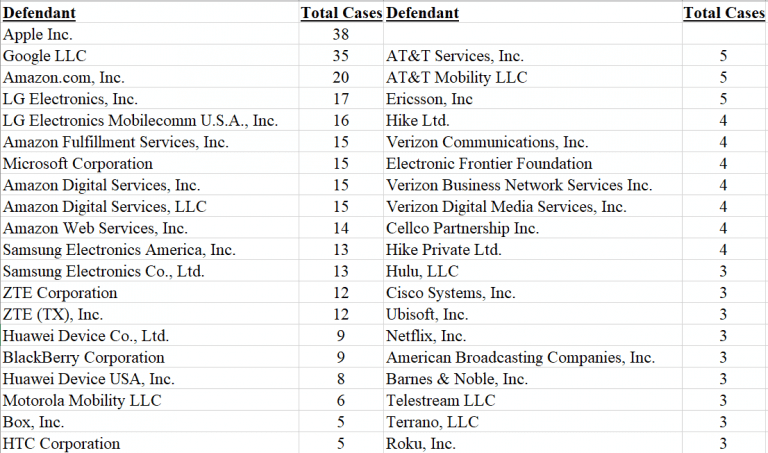

Uniloc: The Most Active Patent Troll

Uniloc purchases patents in order to make money from them through litigation and licensing deals. According to Lex Machina’s 2020 patent litigation report, Uniloc was the most active plaintiff between 2010-2019:

- Uniloc USA Inc. had 460 case filings in 8 districts

- Uniloc Luxembourg S.A. had 396 case filings in 8 districts

- Uniloc 2017 LLC had 205 case filings in 9 districts

Source: Cloud IPQ

So what do we know about one of the world’s most prolific patent trolls? How about their patent portfolio? We harnessed the power of Patentcloud, in particular, Due Diligence to take a good look at Uniloc’s patents. The beauty of Due Diligence is that it brings patent data to life in the form of meaningful, visually pleasing dashboards.

- Uniloc is an Australian patent assertion company which was founded in 1992

- Uniloc produces and develops computer security, and copy-protection software

- The Uniloc technology is based on a patent granted to inventor and Uniloc founder, Frederick “Ric” Richardson

The Ric Richardson Patent

This patent was granted to Uniloc back in 1996, and it relates to the activation of software with an activation key. This method then went on to be the model of online software purchase and activation. By patenting this method, Uniloc was then able to sue basically anyone who used online software activation, thus making it Uniloc’s license to print money. For decades, Uniloc has been trapping software companies and enforcing its patent and suing companies for millions.

The patent covers any method of “try and buy” software activation and is based on the use of an activation key for “try and buy” deals, which unavoidably come up wherever an online activation process is used.

Ric Richardson’s patent secured many triumphs for Uniloc over the years, including a highly-publicized $388 million victory against Microsoft back in 2009 — this decision in favor of Uniloc would have made it one of the biggest payouts in U.S. Patent History. The verdict was overturned a few months later by a trial judge, after a lot of back and forth, the two parties settled for an unknown sum.

Uniloc’s Patent Portfolio

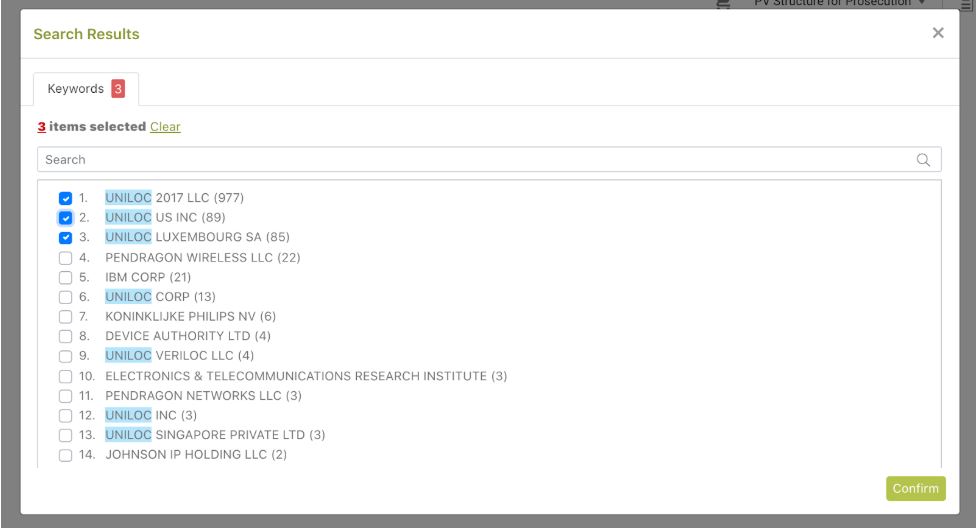

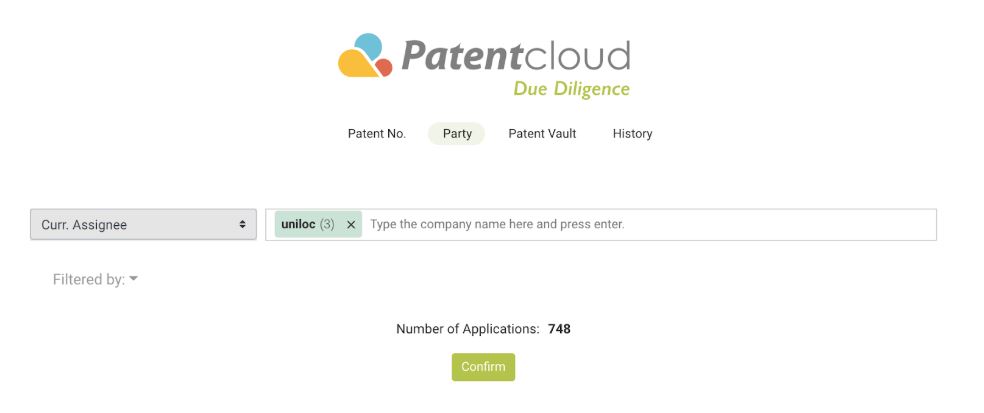

We used Due Diligence by Patentcloud to collect the Uniloc’s patent portfolio. From the “Party” tab, we typed in “Uniloc” to start a current assignee search. By doing so, we collected 748 patents in total by selecting 3 of Uniloc’s affiliate companies.

Image taken from Due Diligence by Patentcloud

Image taken from Due Diligence by Patentcloud

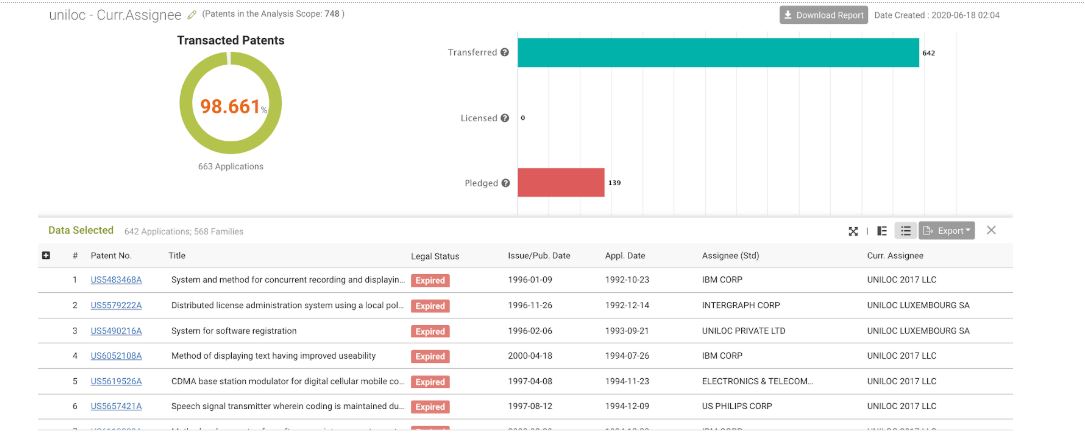

Transacted Patents

First of all, since Uniloc is an NPE that acquires patents from others instead of developing their own patent portfolio, we took a look at the Transacted Patents to confirm that. Unsurprisingly, almost all of the patents were transacted, as you can see, some of the patents were acquired from tech giants such as IBM and Philips.

Image taken from Due Diligence by Patentcloud

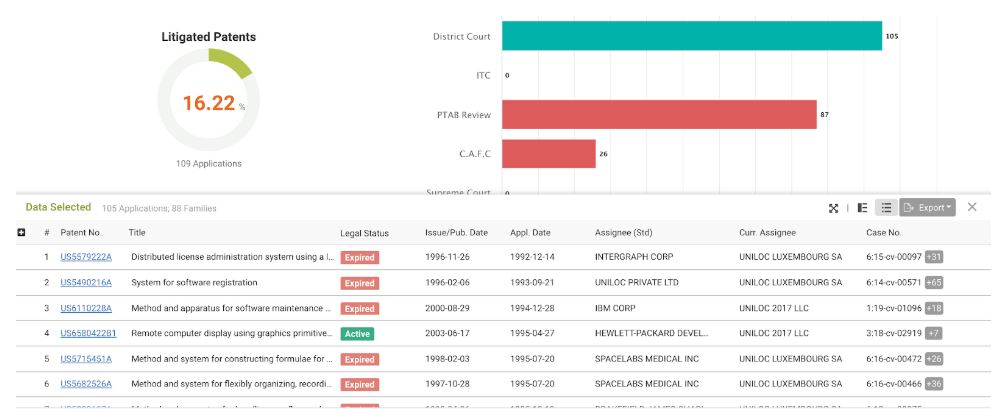

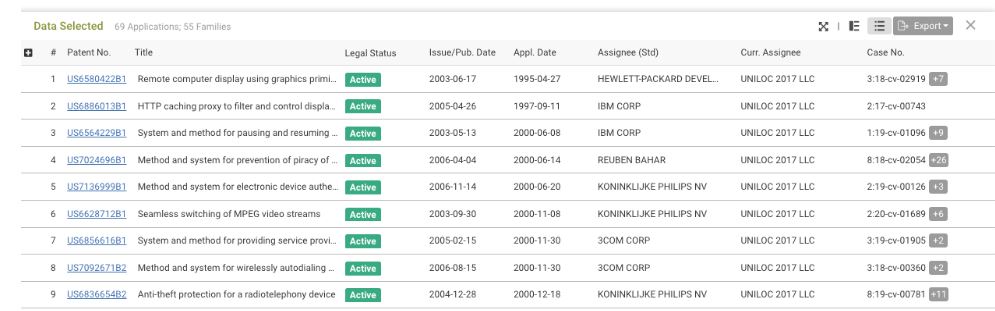

Litigated Patents

Secondly, since Uniloc is a notorious “patent troll,” we should watch out for the active patents that have been used for litigation purposes. We can see that the litigated patents account for just 23% of the total patents, for the patents that were used against others in the District Court, there were only 69 active patents. Although they only account for a small portion of the whole portfolio, they indeed served as major weapons against tech giants including Microsoft and Apple. To dig deeper and extract further details from these patents, we saved these patents to Patent Vault and used another Due Diligence report to analyze just these patents.

Image taken from Due Diligence by Patentcloud

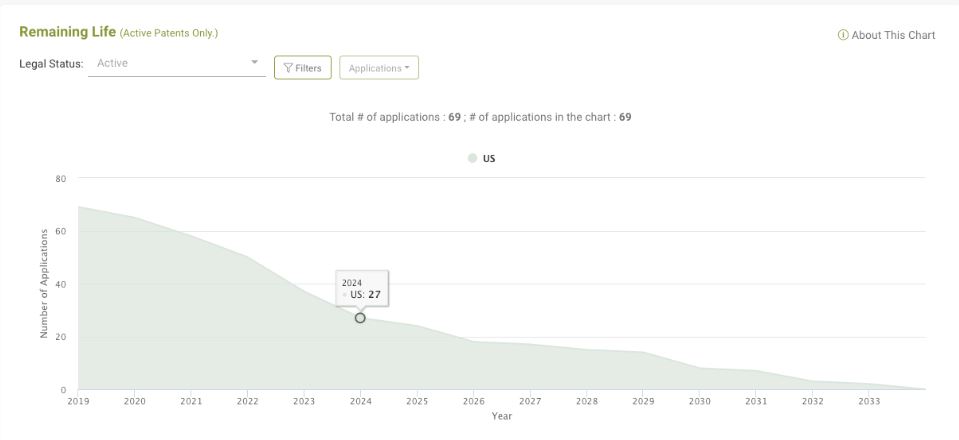

Remaining Life

In the Remaining Life dashboard, we can see how the 69 patents will sustain their validity over the next 20 years. The dashboard apparently shows that in the next 5 years, only 27 patents will still be alive, in other words, 61% of the patents will expire and will no longer be useful for enforcement.

“It’s highly likely that Uniloc will utilize these patents and make the last strike against the potential targets in the next 5 years. Uniloc certainly invested a lot of money in acquiring these patents in the past and will definitely try to extract every last bit of value from them in order to pay the interest to its pledgers and stakeholders. Every potential target should keep an eye on them and prepare in advance.”

– Gilbert Wu, Expert

Image taken from Due Diligence by Patentcloud

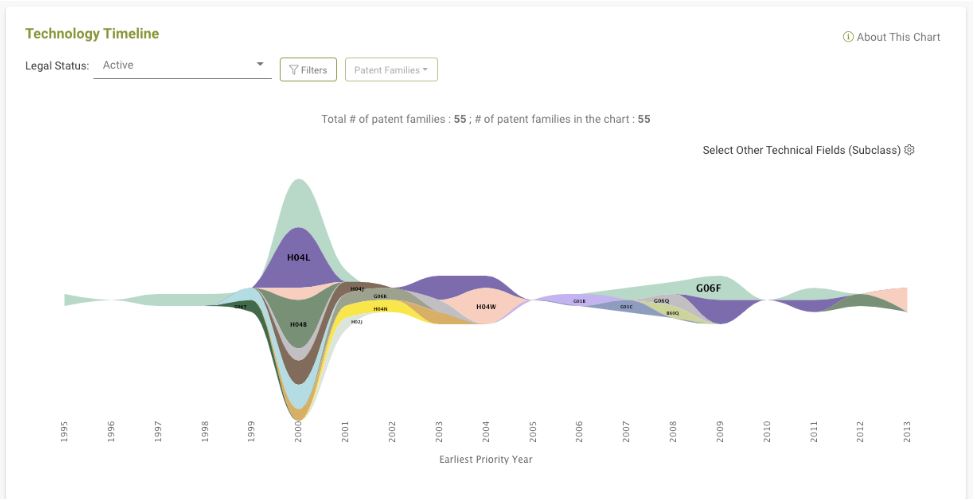

Technical Fields and Technology Timeline

We can see what the technical fields of the litigated and active patents are, they are mostly in the H04: electric communication technique and G06: computing, calculating, and counting categories.

Image taken from Due Diligence by Patentcloud

We can see further information about the earliest priority year of these patents from the Technology and Timeline dashboard: they were mostly filed in 2000, which means most of them will soon expire.

Image taken from Due Diligence by Patentcloud

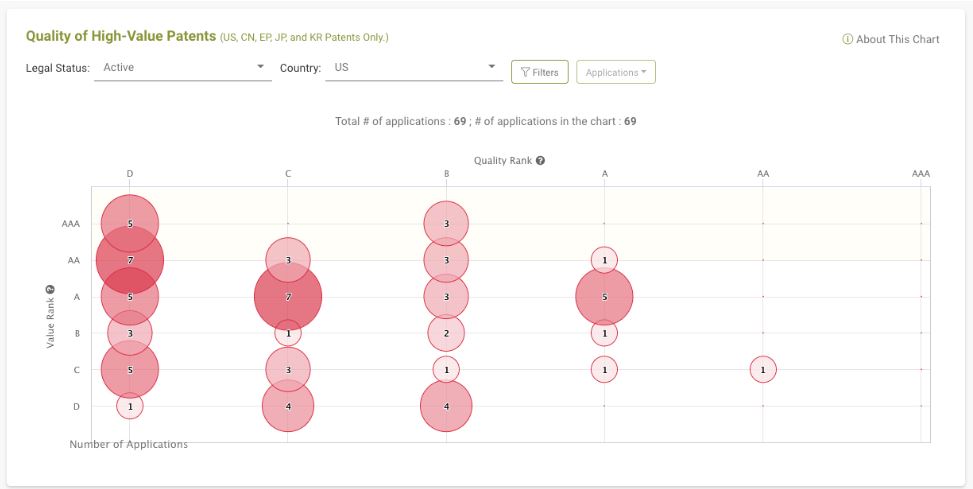

Quality and Value

From the Quality and Value dashboard, we can see the tendency of the patents being transacted or enforced (Value Rankings) and the tendency of being invalidated (Quality Rankings). Almost half of the patents are above A-value, which means there is a high possibility of being transacted or enforced. However, from the Quality aspect, nearly 70% of the patents are below B-quality, which means there is a higher possibility of being invalidated.

“Although the chart tells us something from a statistics point of view, however, I won’t say that those below B-quality patents are all junk. Uniloc chose these patents for reasons. The most convincing explanation is that it is easy to conduct a Claim Chart with these patents, and the commercial products, such as mobile phones, can easily fall into the trap of these patents’ claims, which causes patent infringement.”

– Gilbert Wu

Image taken from Due Diligence by Patentcloud

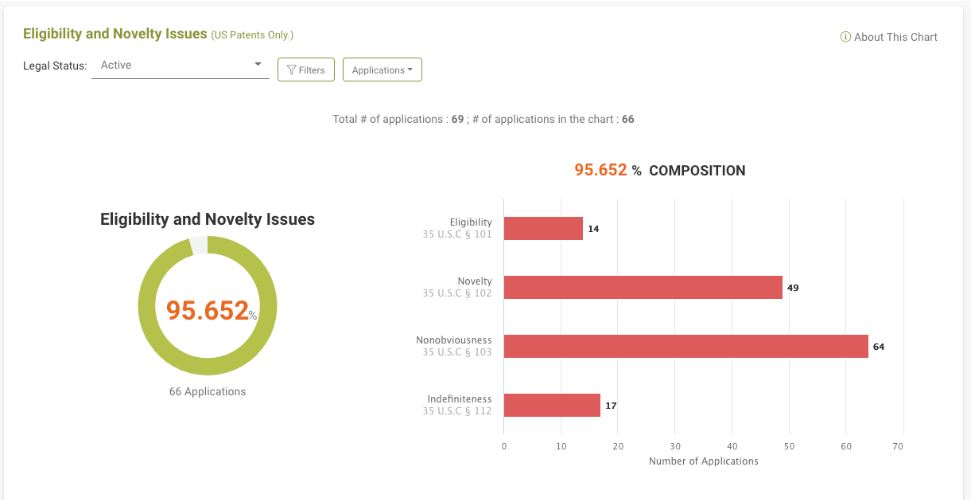

Eligibility and Novelty Issues

From the previous charts, we already know that the Quality Rankings of these patents are lower than average. In the Eligibility and Novelty Issues dashboard, we can get an overview of the challenges that they have encountered in the past during their prosecution or PTAB petitions. Nearly 96% of the patents have encountered quality issues.

“To be honest, with such a high ratio of patents with quality issues, it seems that these patents would be really hard to invalidate instead. No matter what, these patents are still alive, which means that you still need to deal with them for a while, until their expiration.”

– Gilbert Wu

Image taken from Due Diligence by Patentcloud

Potential Targets of the Portfolio

Due Diligence also highlights the potential targets of the portfolio based on the count of forward citations and their applicants.

“Every entity on this list should be prepared. As I said, Uniloc may try to fiercely extract the last bit of value from their portfolio, although these patents will expire soon, these companies still need to pay attention to these litigated patents, find some way to deal with them to lower the risk of damages.”

– Gibert Wu

Image taken from Due Diligence by Patentcloud

How Can You Spot a Potential Patent Troll Risk?

Patent trolls can be easy to detect with the right kind of know-how and advanced software solutions. We will now explain how we keep on top of the patent troll situation with the following tricks and techniques.

US assignment data is often the first signal for patent risk. We can utilize US patent assignment data periodically, and from the data, we can then see exactly what the patent trolls have been acquiring—which patents have been bought.

Secondly, we can check and analyze the assignment data. We can use Due Diligence by Patentcloud to analyze such portfolios, especially the portfolios containing US patents. Most patent trolls just use the US judicial system to sue, patent trolls seldom sue in Asian countries. German and UK courts are usually the only other courts used for suing. We can also use patent litigation data to check the litigation history of the patent troll in question. We can easily identify those patent trolls who litigate frequently.

Finally, we can also take a look at how the patent troll selects the patents to litigate the third party. Patent trolls typically choose the patents via forward citations, Due Diligence can support and show predictions about which patents will be chosen. Additionally, from the quality check on Due Diligence, most patent trolls will select patents with “no quality issues.” Most asserted patents are clean, with no issues.

By following such guidelines, we can potentially limit the risk of patent troll attacks.

Lowering the Risk of Falling Victim to Patent Trolls

We consulted with our expert, Gilbert Wu, to establish whether there is anything that patent owners can do to safeguard themselves against the wrath of the patent troll.

Mr. Wu is the CEO of Wispro Technology Consulting Corporation. Mr. Wu has executed many high-value private transactions between companies globally and has acquired license deals for his clients’ patent assets. Mr. Wu was a practitioner in corporate and commercial areas and has advised industry leaders in M&A projects, global complex disputes, and business transactions.

“If the patent owners can be alerted of the acquisition activities of the NPEs, they may then be able to prepare themselves before the litigation even occurs or before the NPEs come knocking on the door asking for money. For example, the non-infringement opinion, they can also start to collect and investigate the prior art, and try to invalidate the patents before the NPE files litigation.

If I were a company, I would not spend money immediately on invalidation, but I would certainly get prepared and collect the evidence and possibly prepare a complaint and get it ready for if and when the NPE comes, thus allowing me to tell the NPE that I already have the invalidation evidence and I have the complaint petition prepared. If you don’t want me to file this, just go and knock on someone else’s door. Companies can prepare themselves, Due Diligence is a great solution for this problem as the patent owner can check recent transaction activities of the major NPEs. We can also send out alerts to our clients and inform them about which patents have been purchased recently by certain NPEs, we may even prepare the prior art evidence for the client and get all of the defensive preparations ready.”

– Mr. Wu, CEO

The Uniloc data in the downloadable report was updated on 2020/10/24 using the same data scope as featured in the article. You can download the Uniloc report via filling in the form here.