On July 13, Analog Devices formally announced the acquisition of Maxim Integrated for $21 billion. The deal — which is expected to be the largest of the year — will be finalized in the summer of 2021 after the approval of regulators across the US, the EU, and China.

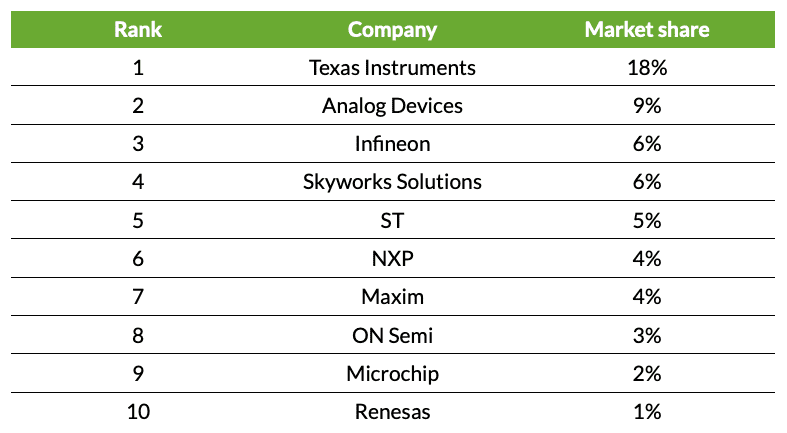

Both companies are major players in the analog semiconductor industry, and the resulting company — valued at around $68 billion — would put Analog Devices in a better position against Texas Instruments, the current market leader.

As we saw in our analysis of the TSMC patent portfolio, R&D and intellectual property play an important role in securing a company’s success in the market. That being said, we expect that Maxim Integrated’s portfolio carried a lot of weight when it came to the acquisition — and its final price.

What could have prompted Analog Devices’ decision-makers to go after Maxim Integrated? To answer this, we will conduct a due diligence analysis on Maxim Integrated’s portfolio and compare it with Analog Devices’ to see what it adds — or doesn’t.

A reminder about the importance of patent due diligence

As all buyers know, patent due diligence is a step that nobody can afford to skip when approaching the patent market. The main reasons are:

- Due diligence helps to identify whether the patent portfolio is of any interest to the buyer

- Once the interest has been confirmed, it helps to assess whether the price proposed for the portfolio is fair or not

- If it is not fair, it also provides bargaining chips for lowering it, leading to fairer transactions

Traditional approaches to patent due diligence provide only limited insights into the portfolio and require an overwhelming amount of work to obtain even the most basic of information.

A better way to conduct patent due diligence

Luckily, there is a better and faster way to analyze a portfolio of patents before acquiring it. With its dashboards, Due Diligence by Patentcloud aids decision-makers by transforming piles of disorganized patent data into meaningful and purposeful charts — see it in action below.

Before reading on, start your 7-day free trial to follow along with us or to conduct your own analysis.

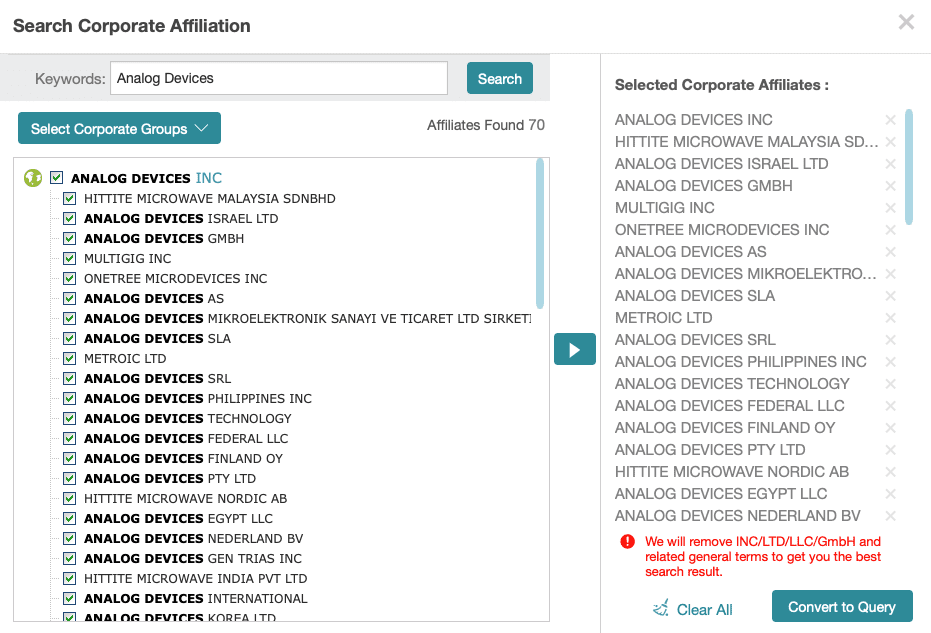

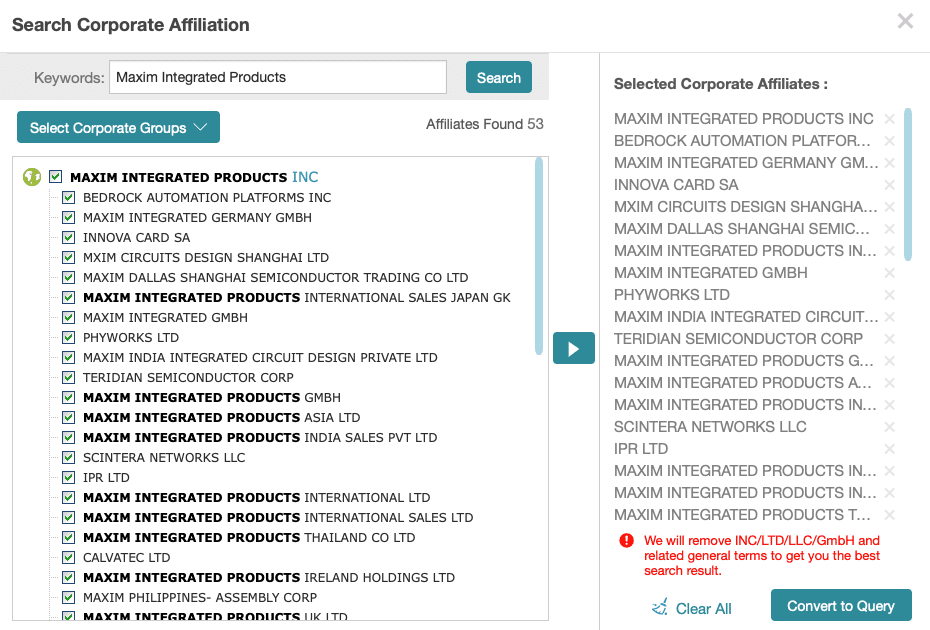

Identifying the Analog Devices and Maxim Integrated portfolios

To collect the patents in each portfolio, we relied on the Corporate Affiliation Search available in Patent Search. This feature identifies all of the subsidiaries and affiliates that a company might have around the world, resulting in a more comprehensive patent search. As we can see below, Analog Devices has 70 affiliates while Maxim Integrated has 53.

Importing and starting the analysis

After gathering the right patents for each company, we saved them in Patent Vault, our patent asset management solution.

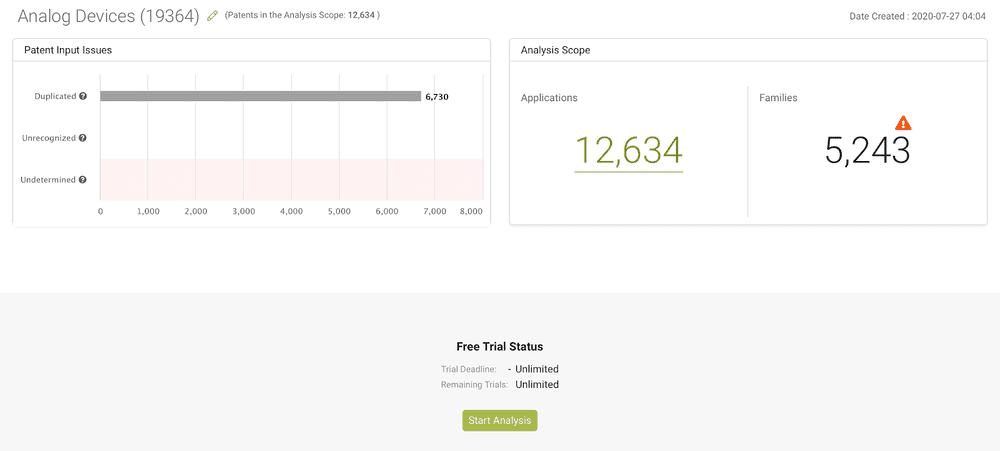

We then imported the portfolios easily into Due Diligence. After a quick check, we clicked the Start Analysis button to obtain a comprehensive patent due diligence report in seconds.

The analysis

We will look at the most significant dashboards for the purpose of this article. It goes without saying that each due diligence process comes with different questions to answer. Scroll to the bottom of the article to download the full reports for the portfolios discussed and find your own answers.

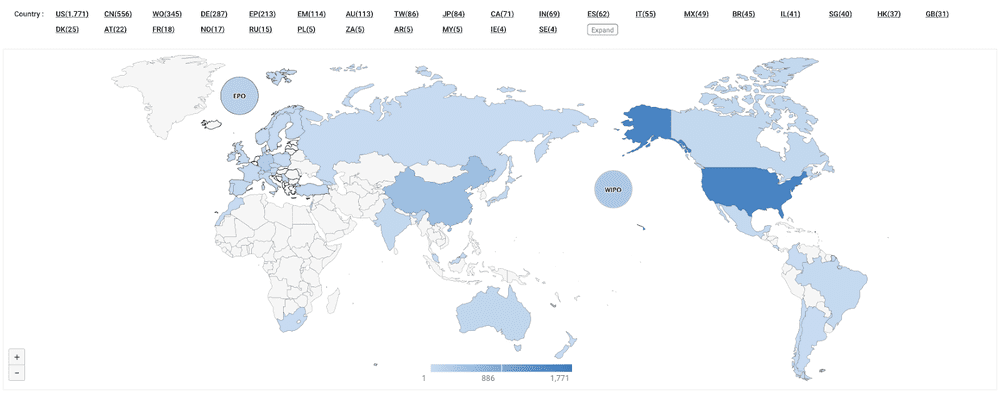

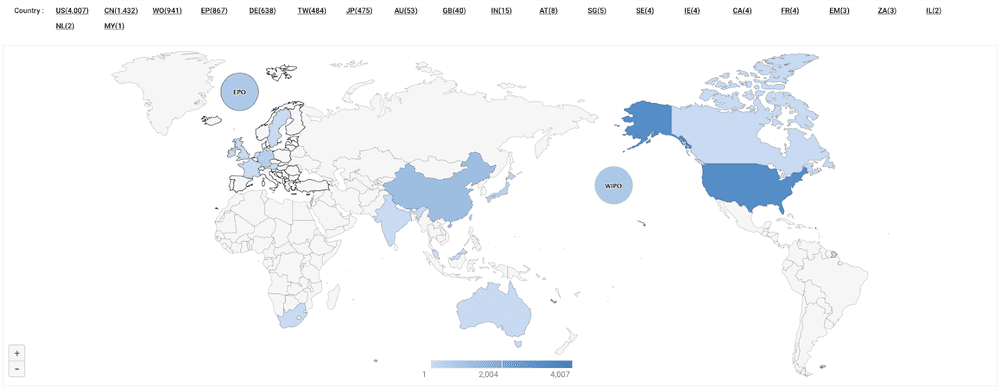

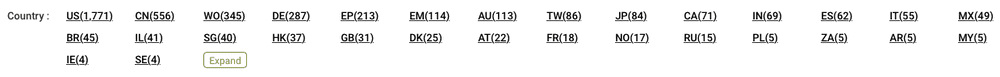

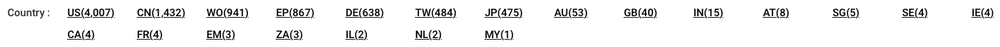

Global coverage

The top 5 patent offices in the portfolio are the US (1,771 patent applications), China (556), WIPO (345), Germany (287), and EPO (213). The coverage focus does not differ substantially from Analog Devices’ coverage focus, for which the top 5 patent offices are the US (4,007), China (1,432), WIPO (941), EPO (867), and Germany (638). By taking the portfolio sizes into account — there are 12,634 patent applications for Analog Digital against 7,125 for Maxim Integrated — the proportional distribution between the patent offices in the top 5 is also very similar.

What is maybe more interesting is that Maxim’s portfolio covers a significantly higher number of countries: 44, against the 21 covered by Analog Devices.

This means that with the acquisition, Analog Devices will acquire patent rights in a higher number of countries, opening up to licensing opportunities in some of those newly-acquired countries.

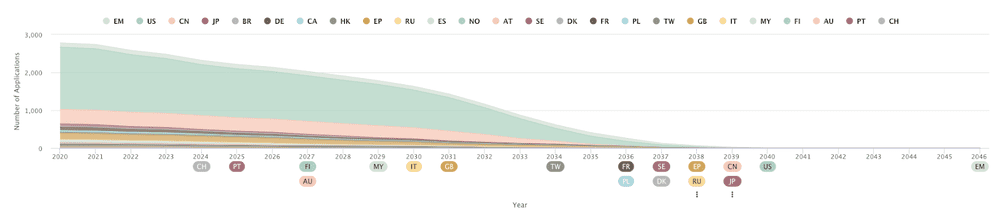

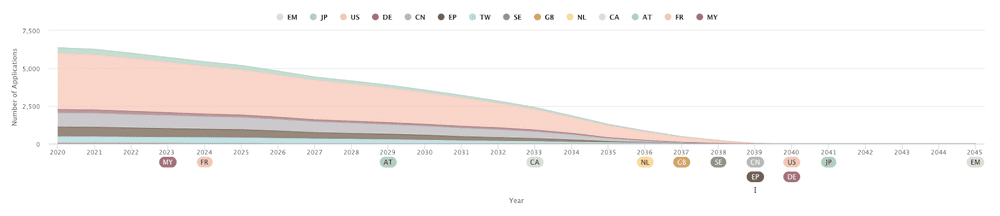

Remaining life

The first patents to expire in Maxim Integrated’s portfolio are those filed at the Swiss patent office (2023). The majority of the portfolio (the patents filed in the US and China) will expire between 2038 and 2039. The expiration of the US patents seems to accelerate around 2030, a signal that most of them were applied for around 2010 (the term of US patents is set to 20 years from the filing date; read here to discover more).

The situation with Analog Digital’s portfolio is similar. The first patents to expire are those filed at the Malaysian patent office (2022), while the majority of the portfolio (US and Chinese patents) will expire between 2038 and 2039. The expiration rate seems to accelerate a little bit later — around 2033.

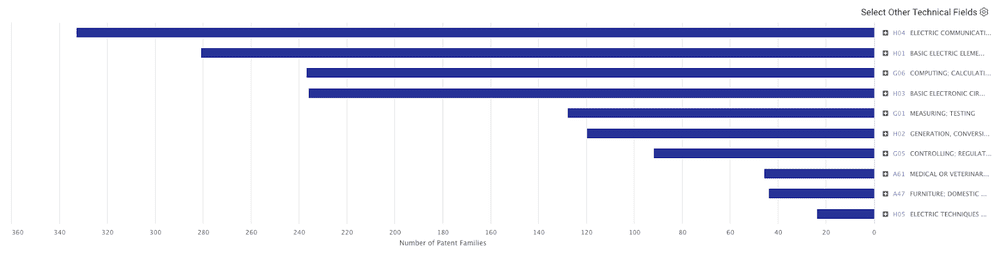

Technology focus

At first glance, we can tell that Maxim Integrated’s portfolio is quite balanced, with none of the classes dominating any of the others. The most-cited IPC classes in the portfolio are: H04 — ELECTRIC COMMUNICATION TECHNIQUE (333 patent families), H01 — BASIC ELECTRIC ELEMENTS (281), G06 — COMPUTING; CALCULATING; COUNTING (237), and H03 — BASIC ELECTRONIC CIRCUITRY (236).

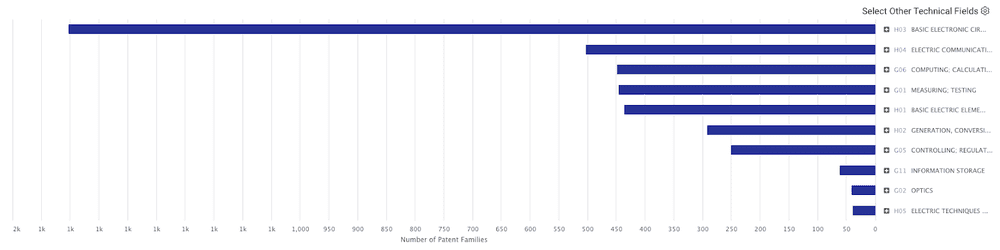

On the other hand, Analog Devices’ portfolio shows a remarkable focus on class H03 (1403 patent families), with the other major IPC classes in the portfolio being similar to Maxim Integrated’s, just with a less pronounced focus.

Analog Devices and Maxim Integrated: two complementary portfolios

This difference in distribution is the key to understanding the reasons behind the acquisition. While both companies have the same technologies in their portfolios (which reflects in their similar product offerings, here and here), each has focussed on different applications.

This is confirmed in the press release that Analog Devices issued after confirming the acquisition:

“Maxim’s strength in the automotive and data center markets, combined with ADI’s strength across the broad industrial, communications, and digital healthcare markets are highly complementary and aligned with key secular growth trends.”

–from the press release

Analog Devices’ strength in the industrial, communications, and digital healthcare markets reflects its sharp focus on class H03. On the other hand, Maxim Integrated’s attention across a broader array of technologies — notably those that Analog Devices has not developed as much as basic electronic circuitry — allowed it to achieve a better position in automotive (H04 & H01) and data centers (H04 & G06).

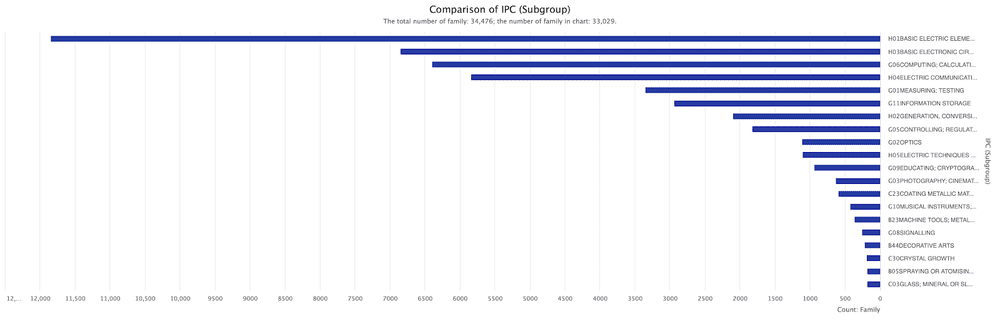

The acquisition will allow Analog Devices to “fill in” the gaps in its portfolio, broaden its product offerings, and ultimately take Maxim Integrated’s spot in those market areas where the latter performs best. As mentioned at the beginning, this would allow it to compete more aggressively against Texas Instruments. A quick look at the technology focus of the current leader in the industry makes things even more evident:

In all of Texas Instrument’s top 3 technologies, Maxim Integrated shows a better focus than Analog Devices.

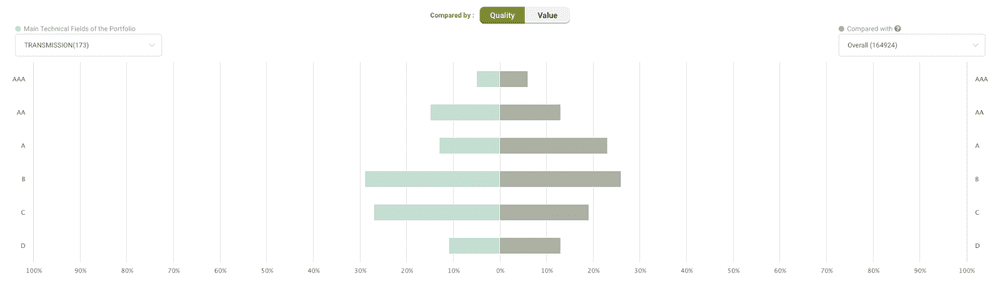

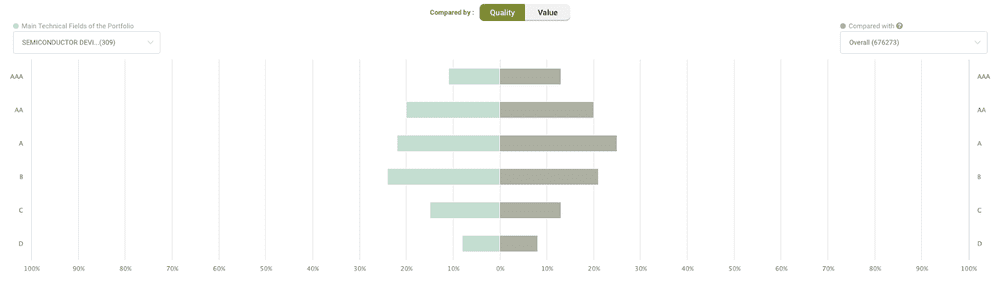

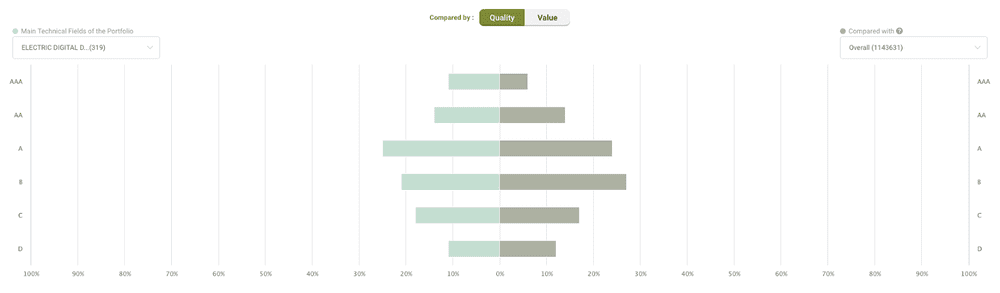

A word on patent quality

As we discussed previously, quality is much more important than quantity when it comes to patents. To take a closer look at this aspect, we can check how Maxim Integrated’s portfolio performs against its peers. To do so, we utilized the Peer Comparison in the Same Field from Due Diligence and focused on the four technologies that we saw make up the most significant part of its portfolio: H04, H01, and G06.

As the charts clearly show, the performance in these IPC classes is comparable to the industry average. In an industry where size and scale make a company more competitive, Analog Devices probably gave priority to building a more complete and diverse portfolio while also ensuring that it had good quality.

The financial viewpoint

For a broader context, we took a look at the financial data of the two companies. In particular, we checked the financial reports published on their websites along with the data available on PitchBook. Here are the three major takeaways:

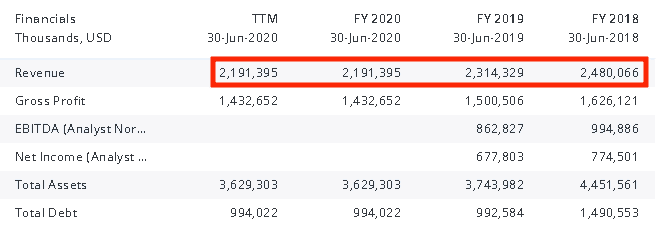

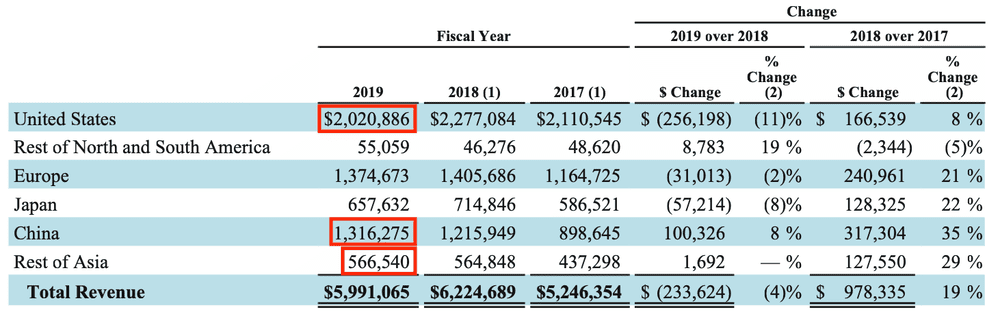

- Maxim Integrated’s overall revenue is decreasing; the chart below shows how Maxim Integrated’s revenue has been decreasing over the past two years. This may have been one of the reasons that pushed Maxim Integrated’s decision-makers toward accepting a deal that the two parties have been discussing for years without reaching any agreement.

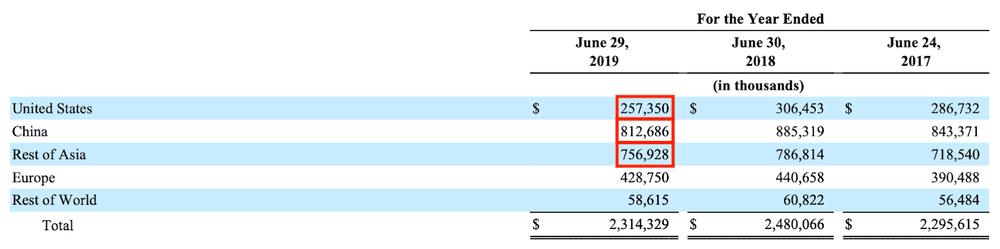

- China is Maxim Integrated’s primary market; by looking at the company’s revenue in 2019 — broken down by geographic region — we noticed that the percentage of revenue coming from China is more than three times that from the US (35.12% against 11.12%), which holds the fourth position after the rest of Asia (32.71%) and Europe (18.53%).

On the other hand, the major revenue source for Analog Devices is the US, holding the first position with 33.73% of 2019’s total revenue. China holds the third position with 21.97% of the revenue; the rest of Asia comes next with just 9.46% of the revenue.

The acquisition is a good chance for Analog Devices to expand towards the East, with the ultimate goal of diversifying its business portfolio location-wise.

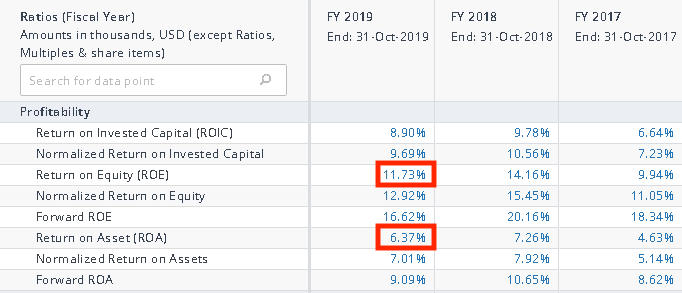

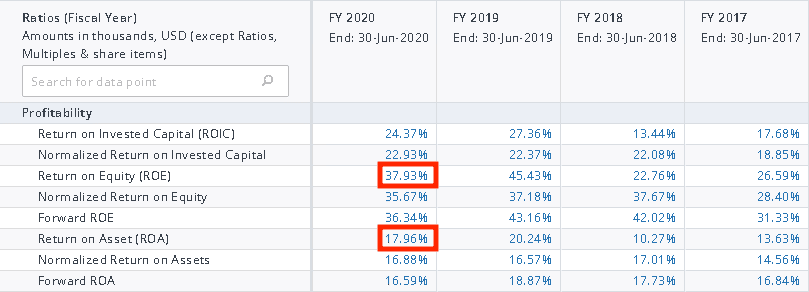

- Maxim Integrated’s generates higher ROE/ROA; by comparing the ratios of the two companies in PitchBook, we noticed that even though Maxim Integrated’s overall revenue in 2019 was much lower than Analog Devices’ ($2,3 billion against $6 billion), Maxim Integrated’s ROE and ROA are much higher than Analog Devices’.

This information tells us that even if smaller on an overall scale, Maxim Integrated generates revenue more efficiently in relation to both its equity and assets — a quality that surely caught Analog Devices’ attention.

Closing thoughts

Once again, patent data gave us the chance to take a look behind the scenes of the M&A world. As we always ask at the end of our articles: Was the deal worth it? From a patent perspective, it certainly was: Analog Devices’ move is based on strong foundations, and it will certainly give it more competitiveness in the sector. Will this deal be the end of Texas Instrument’s supremacy?

Would you like to conduct your own analysis of this portfolio or another portfolio of your choice? Click here and take advantage of the free trial to enjoy all of the advanced features for 7 days. No credit card required.