The electric vehicle (EV) industry has been booming over the last few decades. Read our guide to discover all you need to know about it: the reasons behind its success, the major technology breakthroughs, and what to expect in the near future.

Table of contents

- A promising start

- A renowned necessity

- An expanding market

- The EV market by the numbers

- What are the main components of an electric vehicle?

- Major technological breakthroughs

- Patent trends

- Key players and their focus

- Notable innovations

- Quality and value

- What’s next?

A promising start

If you think that the electric car saga started with Elon Musk and his Tesla, keep reading: this type of vehicle started being mass-produced in the US as early as the beginning of the 20th century. Back then, electric cars were so widespread that 28% of all the cars produced in the US in the year 1900 were electric. The first era of electric cars, however, was short-lived: improvements in internal combustion engines, the increased affordability of gasoline, and the introduction of Ford‘s assembly lines, caused a loss of interest in the daily use of electric vehicles starting from the 1920s.

A renowned necessity

After the second wave of interest fueled by the invention of the lithium-ion battery in the 1980s, the development of electric vehicles started to be seen as a necessity along with a deeper understanding of the environmental impact of fossil fuels and fears related to the reach of peak oil. In a few years, all the major players in the automotive sector (notably Chrysler, Ford, GM, Honda, and Toyota) jumped on the bandwagon with their own vision of future mobility, followed by a flock of startups that have tried — with various degrees of success — to replicate the success of Tesla.

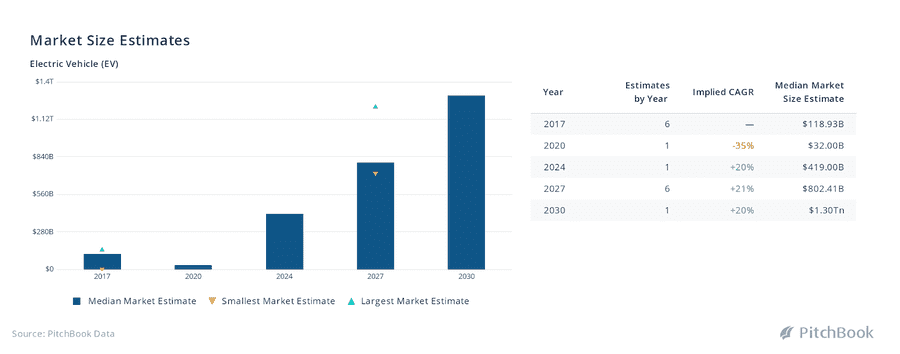

An expanding market

Environmental concerns aren’t the only reason the EV market has grown exponentially. The opportunities it brings across a wide array of industries have also accelerated its development: with an expected market size of $1,299.3 billion by 2030 (which equals to a CAGR of 19.8%), this sector is set to be one of the most successful in the future.

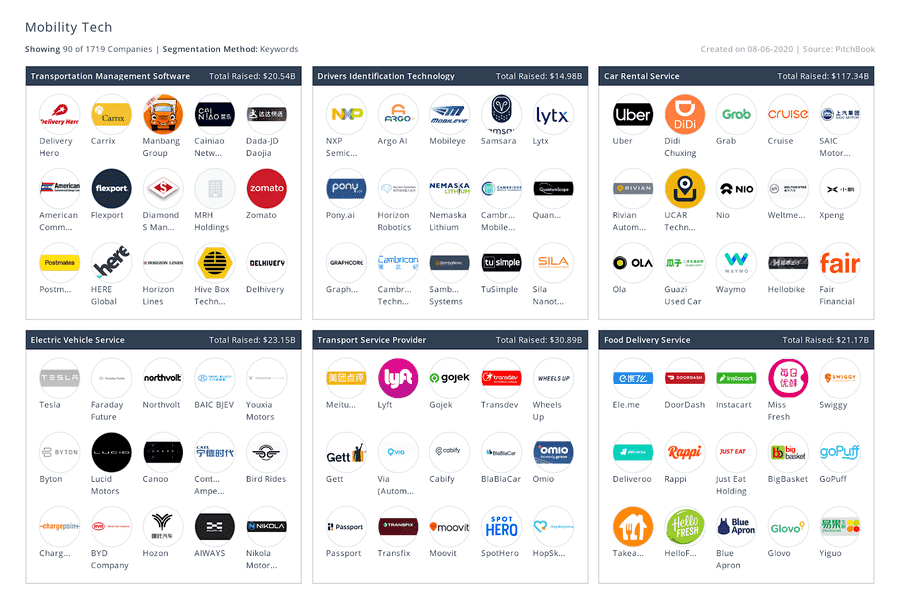

Another litmus test of the interest surrounding an industry is the amount of funding raised by the companies (especially startups) operating within it: the higher the amount, the higher the confidence investors have in the industry’s future. With a total of $23.15 billion raised — among the highest in the most funded segments in mobility tech — we can confidently say that the expectations for this industry are quite high.

The EV market by the numbers

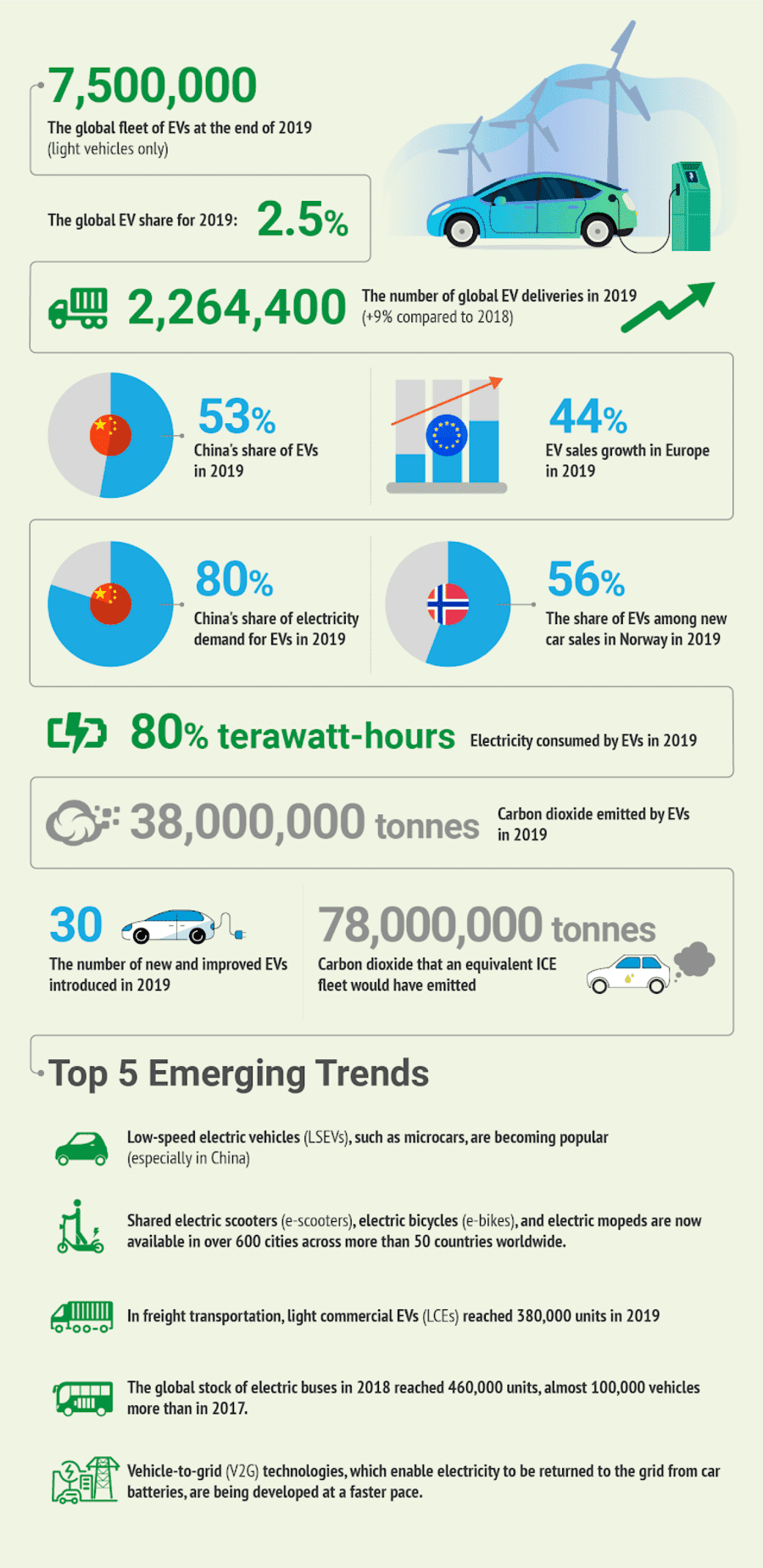

But what is the current status of the industry? While the pandemic certainly brought some degree of uncertainty (especially with the quarantines and factory closures in China during Q1 that disrupted the supply of parts and components), we can take a look at a snapshot from the end of 2019.

It is worth noting that the growth in 2019 shrunk considerably compared to the previous six years, in which the increase fluctuated between 46% and 69%. This slowed-down growth has to do with decreased sales in the two major markets, the US and China, which result from reduced subsidies, modifications of technical regulations, and the fall of oil prices.

What are the main components of an electric vehicle?

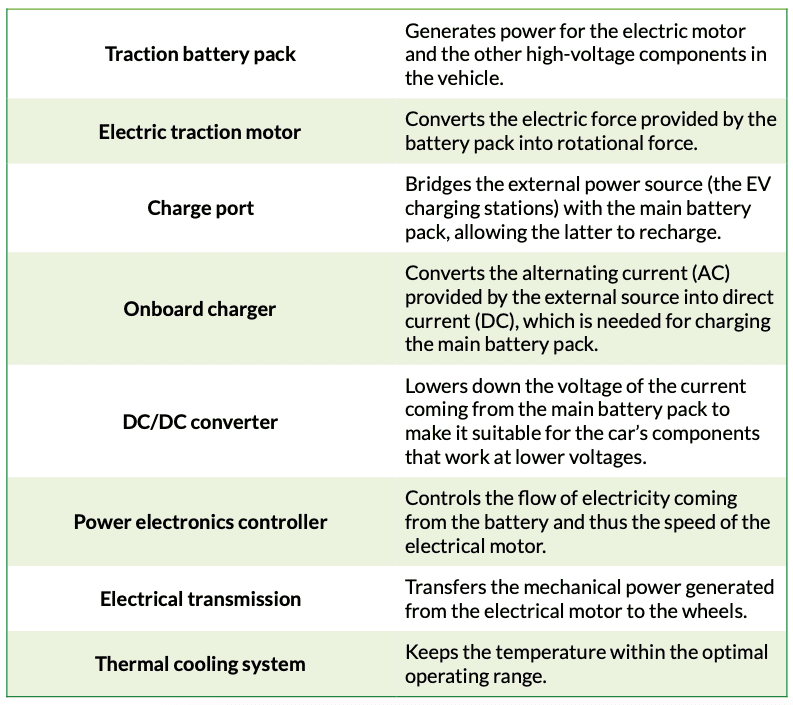

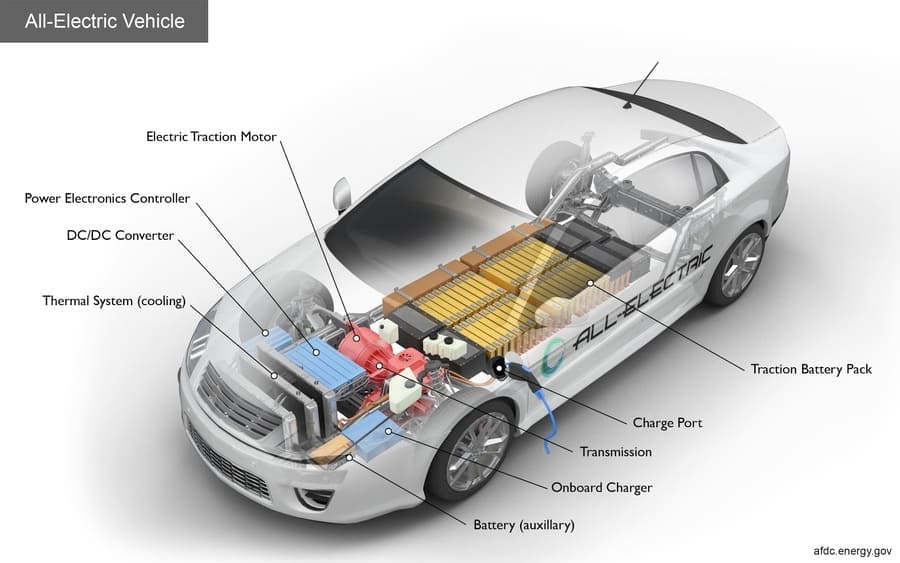

The key difference between the majority of the vehicles circulating today and their electric counterparts is that the latter relies on electric motors to generate movement instead of internal combustion engines (ICEs). While electric vehicles share a number of components with ICE ones, some are exclusive to battery-powered systems. The table below details the major components found in electric cars together with their function within the system.

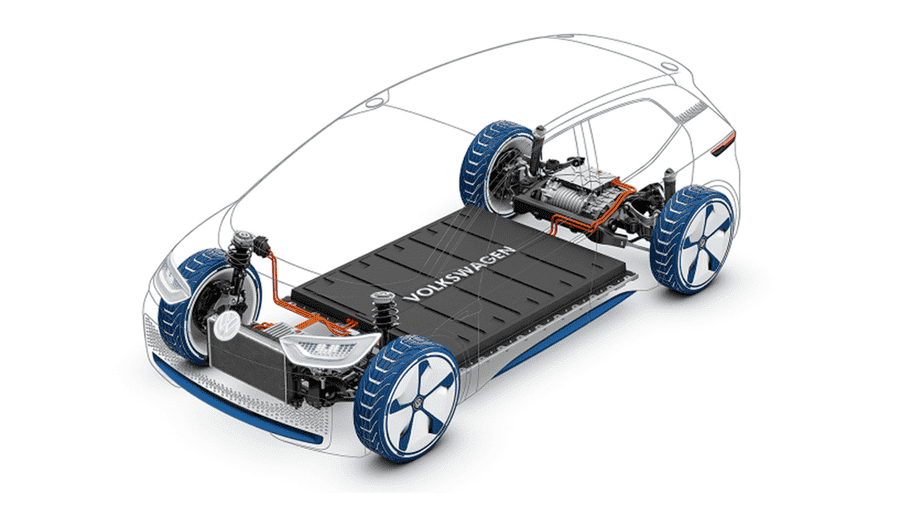

It is worth mentioning that electric cars also include an auxiliary battery, separate from the main battery pack, which is responsible for powering up the vehicle’s accessories that operate at a low voltage (as well as initiating the startup process). The image below shows how these components are traditionally arranged within the car body.

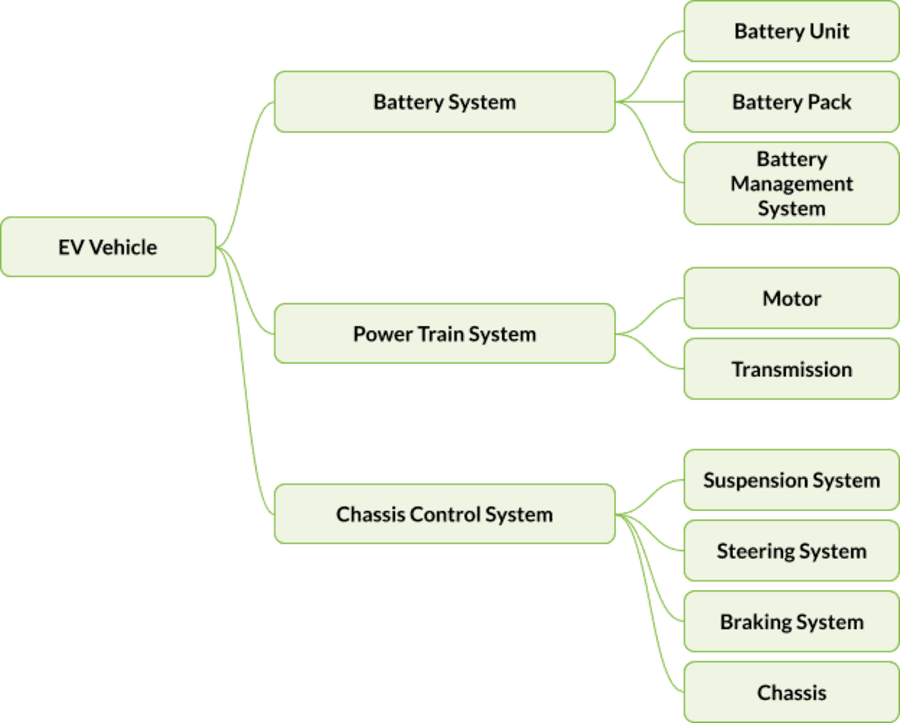

These components are grouped into two major systems according to the purpose that they have within the overall car ecosystem:

- Energy system — it includes the traction battery pack and the battery management system, and it is responsible for generating the electricity needed by the electric motor.

- Powertrain system — it comprises the main components that generate and deliver power to the road surface, such as the electric motor and the electric transmission.

No car, however, could hit the road without another essential system: the chassis control system. This system is essential for supporting the components above and allowing the vehicle to interact with the road itself. The main subsystems included are:

- Suspension system — it connects the vehicle’s main body to the wheels, supporting both road handling (how the car reacts to the driver input such as steering) on one side and ride quality (how well the car can compensate the imperfections of the road) to the other.

- Steering system — it allows the driver to adjust the course of the vehicle.

- Breaking system — by relying on mechanical friction, it allows the driver to slow down or stop the vehicle.

- Chassis — it is the main supporting structure, on which the main battery pack and the other components are arranged.

Major technological breakthroughs

Spanning over a century, with several ups and downs, the history of electric vehicles has been characterized by a number of milestones. After the end of the so-called Golden Era in the 1920s, technological development in the industry mainly focussed on strengthening the competitiveness of electric cars against their ICE counterparts, particularly in the area of distance covered. The brief timeline below also highlights the players that most contributed to the global growth of the EV market.

- 1834 — The first electric motor: after several failed attempts by other inventors, Thomas Davenport of Vermont introduced the first usable electric motor, which he used to power a small carriage.

- 1859 — The first batteries: in France, Gaston Planté invented the lead-acid battery.

- 1881 — Improved battery life: Camille Alphonse Faure improved Plante’s invention by adding capacity.

- 1884 — The first viable electric car:Thomas Parker, an English inventor dubbed the “The Edison of Europe”, introduced the first commercially available electric car. The first era of electric cars begins.

- 1899 — Edison’s quest: Thomas A. Edison started working on further improving battery life and capacity, believing that electric cars will be the leading means of transportation in the future. His research, that he abandoned a decade later, led to better alkaline batteries.

- 1964 — GM experiments with EV: the Electrovair, a Chevrolet Corvair converted to run on batteries, became General Motors’s first experiment with electric cars. A few years later, the company ran another series of experiments that led to the Electrovette, an electric Chevrolet Chevette.

- 1967 — AMC jumps on the bandwagon: American Motors Corporation (later acquired by Chrysler) presented its prototype of future mobility, the Amitron. Its launch into the market — originally planned for a few years later — never happened.

- 1971 — NASA goes electric: NASA’smission Apollo 15 is equipped with an electric vehicle — the Lunar Rover — designed to allow astronauts to cover longer distances while conducting experiments on the lunar surface.

- 1972 — Hybrid cars are born: the first full-powered, full-size hybrid vehicle was built by Victor Wouk, the “Godfather of the Hybrid”. The base model was a 1972 Buick Skylark provided by GM.

- 1980 — Better batteries: by inventing the cobalt-oxide cathode, John Goodenough and his team at the University of Oxford laid the foundations for lithium-ion batteries, which in just a few years became the standard in consumer electronics. Thanks to this new type of battery, electric cars were soon able to travel hundreds of miles on a single charge.

- 2006 — A promising startup: Tesla unveiled the prototype of its first car, the Roadster. A luxury sports car (with a price point of $80,000), it can cover more than 200 miles on a single charge using lithium-ion batteries, which then became an industry standard.

- Feb 2008 — Tesla hits the road: the first Tesla Roadster was delivered, becoming the first highway legal electric car to use lithium-ion batteries.

- 2009 — Longer trips: charging infrastructures began being rolled out in the US and throughout the world, adding miles to the EV fleet capacity.

- 2010 — No more fear: “range anxiety” — the fear of running out of battery before reaching a charging station — was tackled by General Motors with the Chevrolet Volt, the first plug-in hybrid electric car (called by the company “range-extended electric car”). One of the biggest obstacles to electric cars adoption is taken down.

Patent trends

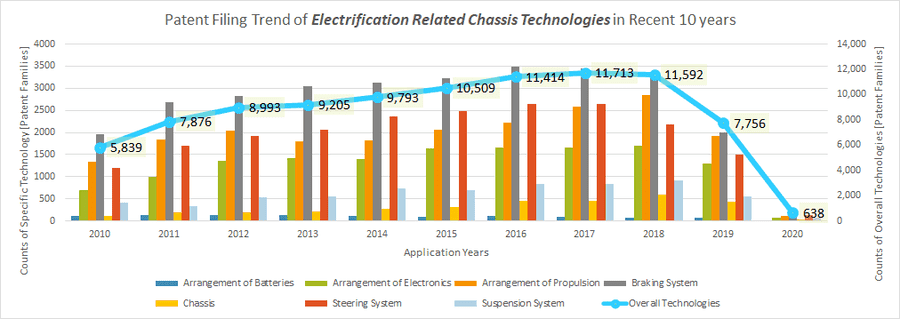

Since, as we saw above, the chassis control system acts as a sort of backbone that offers support to all the other systems and components within them, this first episode in the series focuses on the patent trends identified within this area. To start, the following technologies were identified as essential for innovation in the system:

- Arrangements of Batteries

- Arrangement of Electronics

- Arrangement of Propulsion

- Braking System

- Steering System

- Suspension System

- Chassis

Each technology was then carefully mapped into a specific IPC code so that patents related to these technologies could be efficiently found in Patentcloud’s Patent Search and analyzed. However, the IPC class proved to be not precise enough. In fact, chassis-related technology is utilized not only by electric vehicles but also by ICE and autonomous vehicles (which can be both gasoline-powered or battery powered). A further narrow-down using keywords contained in the title, abstract, and claims of patents was carried out to isolate the patents that specifically apply to the EV market.

The time frame considered covers the past 10 years, with the count including patent families from the patent offices in the IP5 and WIPO.

Trend 1 — Overall filings are increasing, but the sub-technologies are moving at different speeds

This chart shows the filing trends for both the individual technologies considered as well as the cumulative trend. It is interesting to notice that the proportion of the various technologies remained substantially consistent year after year, with the Braking System, Steering System, and Arrangement of Propulsion leading the way throughout the decade while Arrangement of Batteries and Chassis can be identified as the technologies that registered the lowest number of patents.

As for the overall trend, it is clear how the sector has increasingly attracted attention from a patent perspective, with sustained growth at the beginning of the decade. Beginning in 2016, this growth seems to have stabilized. It is also worth noting that the downtrend noticeable since 2018 has to do with the 18-month delay between filing patent applications and their publication, not with an actual drop in patent filings.

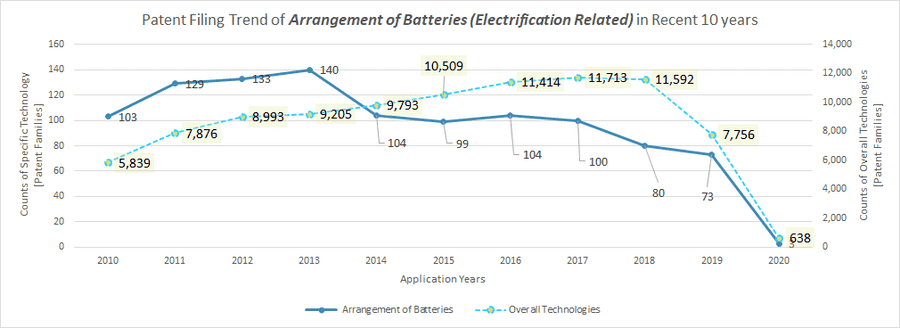

Trend 2 — Arrangement of Batteries attracted early interest, followed by downtrending filings

As mentioned above, this technology is the one that has been patented the least over the past decade. By comparing its patent filing trend with the overall one, we noticed that most patents were filed in the first five years of the decade. This suggests that the key players in the sector focussed on how to improve the arrangement of the traction battery pack during the first years of the new wave of interest for electric vehicles, moving on to other technologies in the most recent years. Nonetheless, patents in this area are still being filed, and several important innovations are still being introduced (as we are going to see later).

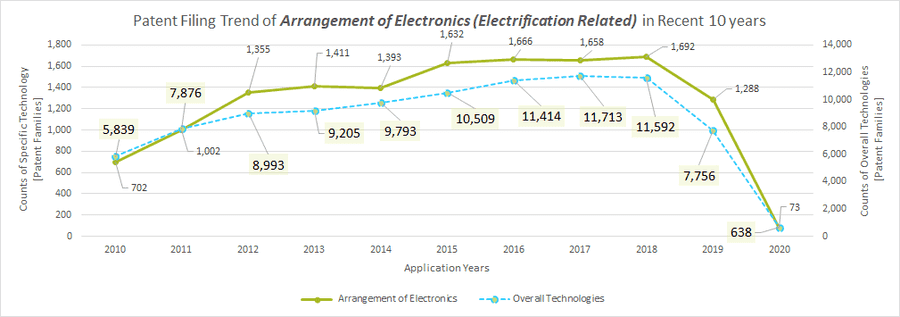

Trend 3 — Filings for Arrangement of Electronics are growing at above-average rates

The filing trend for this technology highlights how innovations related to the arrangement of the electronics within the chassis have grown in number over the years, following the overall trend but at higher rates. A plateau was reached at the beginning of the decade, between 2012 and 2014, followed by a renewed interest in the following years.

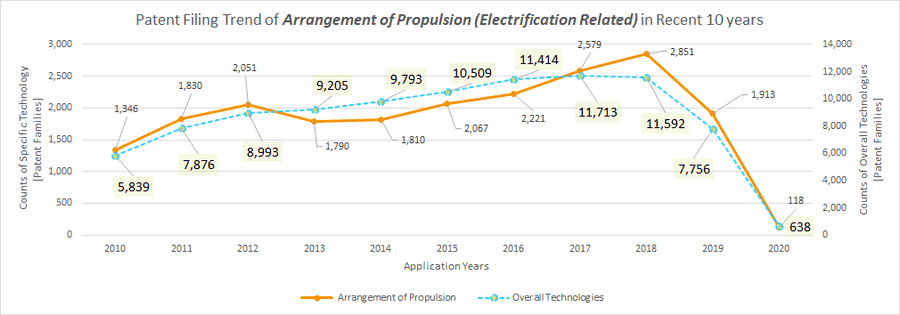

Trend 4 — Filings for Arrangement of Propulsion have reached a peak in recent years

The patents in this technology also experienced a drop in filings between 2012 and 2014, followed by a sustained growth that in 2017 seems to have reached its peak. Since then, the technology regained its second position among the most patented technologies for the first time since 2013, when Steering System-related patents surpassed it.

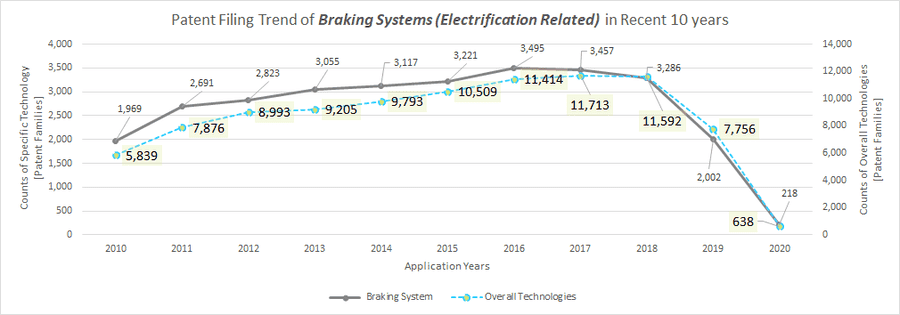

Trend 5 — Braking System patents are gradually falling below the average

As the most patented technology in the lot, its patent filings have consistently grown year after year, driving most of the sector’s growth. After years of above-average growth, the figures started to decline after 2018 slightly.

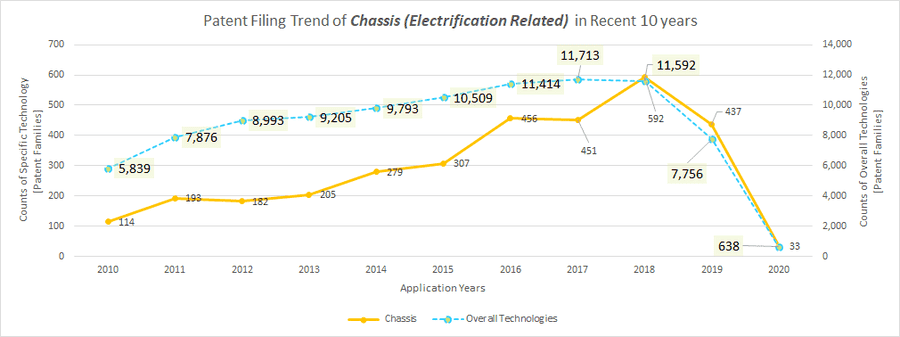

Trend 6 — Chassis-related patent filings have recently picked up

Together with Arrangement of Batteries, the design and layout of the chassis itself is the area that, in the past decade, has been patented the least. However, starting in 2015, its patent filing activity has increased in leaps and bounds, peaking in 2018. As we are going to see below, the renowned interest in this industry area has to do with innovations introduced by some of the key players in the scene (as well as a few startups).

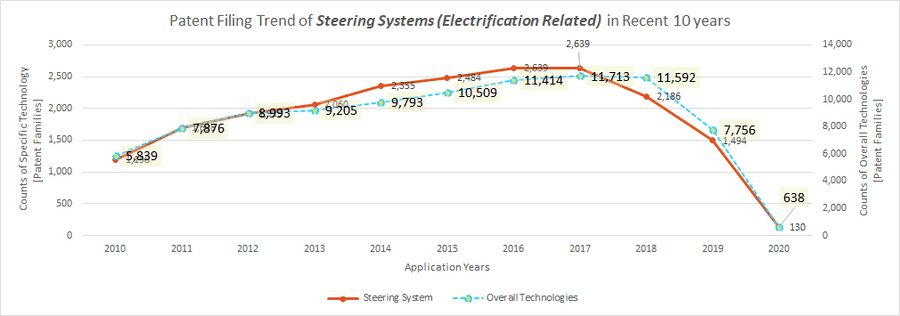

Trend 7 — Steering System filings slowed down in recent years

Steering System is another technology that has been patented consistently during the last ten years, ending up in the industry top 3. Compared to the overall trend, we noticed a slow start, with filings that have started to grow steadily only between 2012 and 2013.

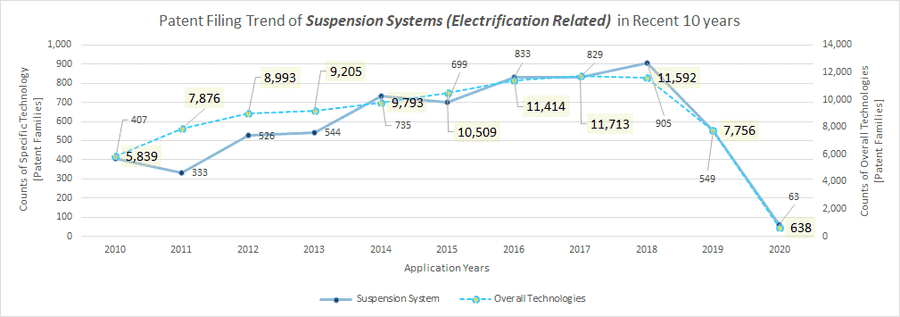

Trend 8 — Suspension System filings started slow, but took off in recent years

The interest surrounding this technology began only after 2014 after a few years of stopping and starting. Together with those in Chassis and Arrangement of Propulsion, patent filings in Suspension System technology were on an uptrend in 2018, before the lack of data related to the 18-month publication delay resulted in a downtrend in the chart. That being said, we can expect these technologies to receive more and more attention in the years to come.

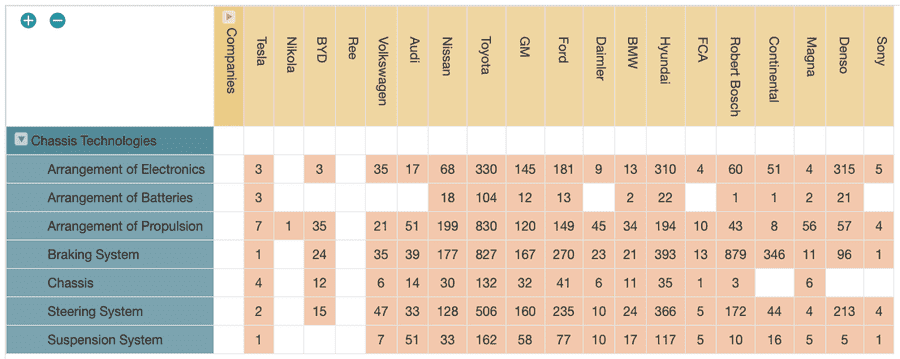

Key players and their focus

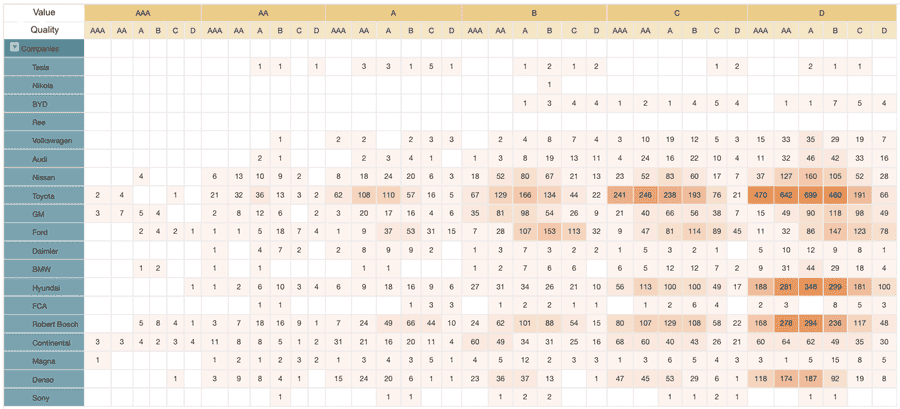

The same data collected for the charts above were then inserted into a PatentMatrix Dashboard to check which technologies the key players in the industry are focussing on.

The dashboard provides a few interesting insights:

- Tesla, despite having brought a few influential innovations to the EV industry, owns just a few patents. This comes as no surprise considering Elon Musks’ view of patents as something that “stifle progress, entrench the positions of giant corporations and enrich those in the legal profession, rather than the actual inventors.”

- The top 3 filers in the sector are Toyota, Hyundai, and Bosch.

- Nikola, a Tesla competitor that focuses on long-distance trucks and off-road vehicles powered by hydrogen fuel cells, also shows limited patenting activity in the chassis control sector.

- While most companies focus their patenting activity on at least two to three technologies at the same time, a few of them — notably Bosch, Continental, and Denso — show a strong commitment to a single technology (Braking System for Bosch and Continental, Arrangement of Electronics for Denso).

What is particularly interesting is the massive portfolio accumulated by Toyota, which is almost certainly the result of its leading position in the hybrid cars and SUV market: the company, in fact, was the first to mass-produce and sell this type of vehicle in 1997 with the introduction of the Prius. In recent years, following probably worldwide governments’ push towards green solutions — and the resulting more stringent regulations — Toyota also invested considerable resources into the development of battery-powered vehicles.

What is more, the company’s vision for future mobility doesn’t seem to give priority to lithium-ion batteries (today’s standard in the industry, as we saw), but fuel cell systems powered by hydrogen. This year, however, Toyota announced a partnership with Panasonic to push forward research into solid-state batteries. This type of battery is regarded as a solution capable of providing increased range while keeping weight and cost down.

With this diversified offering, it comes at no surprise that Toyota’s patent portfolio in the chassis control sector is by far the biggest among the major players.

Notable innovations

As we mentioned, in order to reduce greenhouse gas emissions, governments around the world are actively promoting electric vehicles. As a result, traditional automobile manufacturers and start-up companies are pushing their R&D efforts forward in this sector.

Chassis technologies are a good starting point for this revolution, the reason being that these systems — since they can be utilized in both traditional and electric cars — can facilitate the transition by lowering costs while pursuing electronic integration of various mechanical modules or a more flexible spatial configuration.

For example, Volkswagen‘s Modular Electrification Toolkit (MEB) chassis platform — which has been applied to the group’s various models including Audi, SEAT, Škoda, and Volkswagen itself — has the goals of “consolidate electronic controls and reduce the number of microprocessors, advance the application of new driver-assistance technology and somewhat alter the way cars are built.”

According to the company, this innovative platform brings several benefits:

- Increased space for the occupants

- Best positioning specs for the main battery pack

- Battery capacity variability according to each driver’s demands

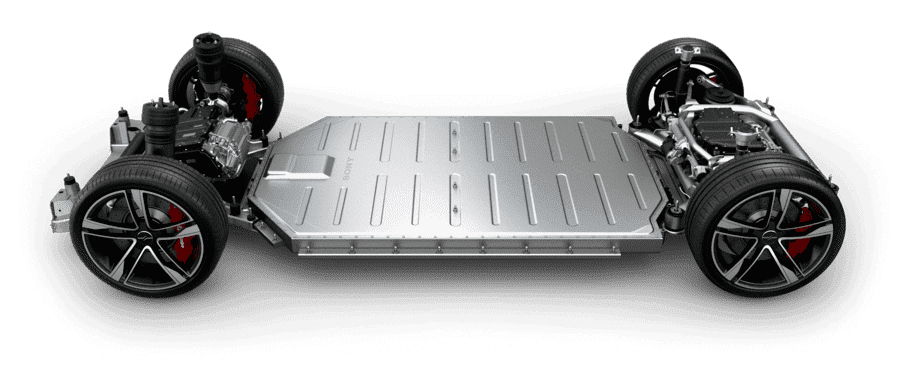

A similar concept was introduced by Sony with its VISION-S concept car, announced to the public at this year’s CES in Las Vegas. Key points of its design are a compact powertrain layout and an ultrathin battery pack, which combined allow for more freedom in arranging the cabin environment. Great attention is also put on the safety features, as specified by one of Sony’s press releases:

“The car is designed with the goal of acquiring top scores in automobile safety tests around the world.”

– Sony’s press releases

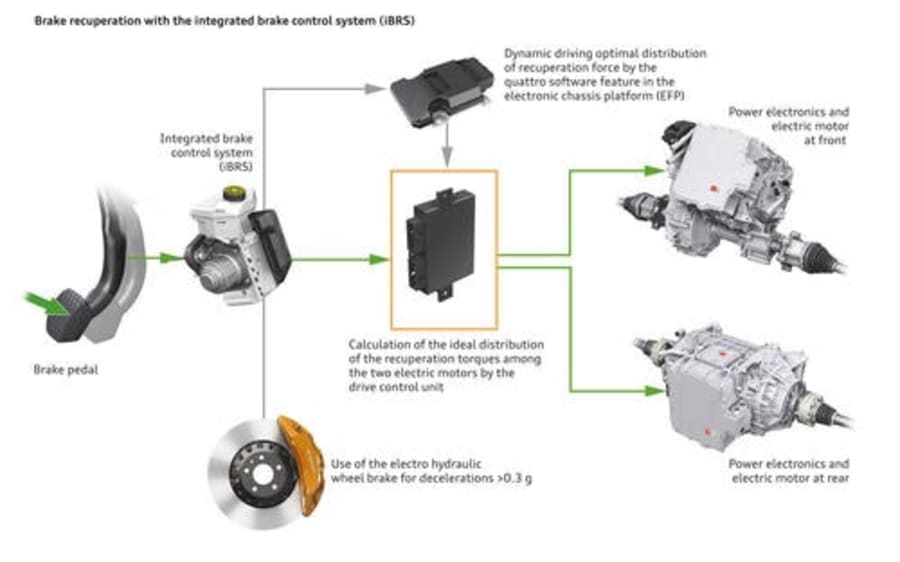

In addition to the modular chassis solutions introduced by Volkswagen and Sony, Audi is trying to connect the various systems involved in the chassis (suspension system, braking system, and steering system) through electronic chassis technology to improve driving comfort, flexibility, and efficiency. The result of this concept is the Electronic Chassis Platform (ECP), which interlinks the individual components of the chassis systems in Audi’s mid-size, full-size and luxury models to coordinate their functions through the use of software. The earliest actual use of this platform was the Audi Q7 in 2015.

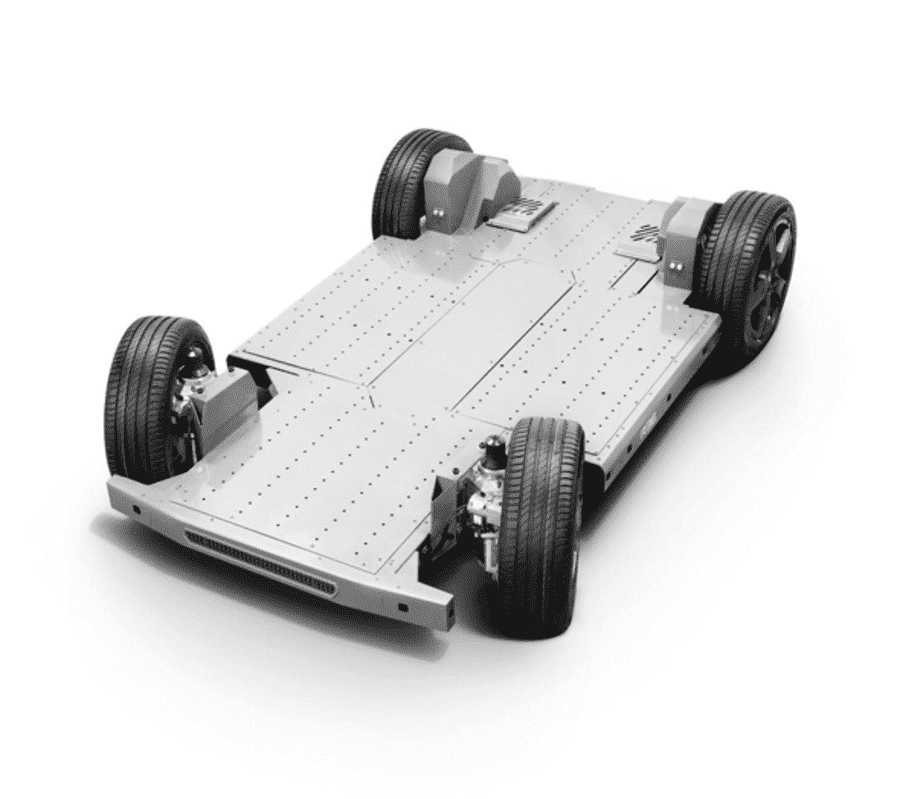

A third innovation to keep an eye on comes from the Israeli startup Ree Automotive (founded in 2011), which has developed a technology to integrate powertrain, steering, suspension, and motor into the wheels to achieve a flat chassis system. Integrating the main components into the wheels gives car manufacturers a great deal of freedom when it comes to arranging the space within the vehicle. However, its clearest advantage resonates greatly within the EV industry: a completely flat chassis design allows for a considerably bigger battery pack, characteristic that could overcome — at least in part — the capacity limitation of today’s batteries.

Quality and value

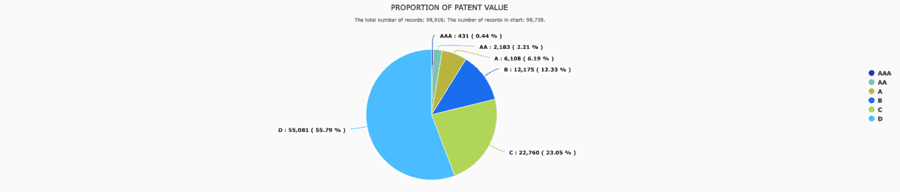

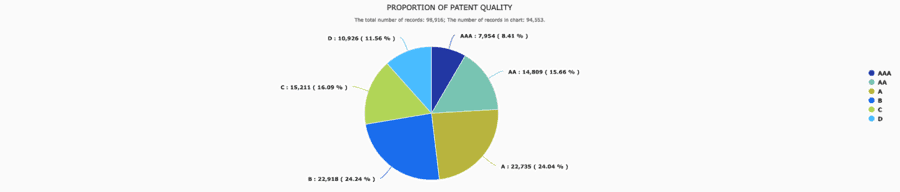

Last, but certainly not the least, we took a look at the quality and value of these patents: when it comes to intellectual property, quality is much more important than quantity. With the help of another PatentMatrix Dashboard and in a matter of just a few clicks, we obtained the following chart that details the quality and the value of each player’s portfolio in the chassis control system for EVs.

We noticed straight away that the average value of the patents involved leans toward the low end of the spectrum: D-ranked patents, in fact, make up more than 50% of the total. One possible explanation for this low value may be that, being a relatively new industry, the monetization activities involving EV patents in general is still quite limited.

Completely different is the situation concerning the quality of these patents, with AAA-, AA-, and A-ranked patents reaching almost 50% of the total. The companies with the highest number of high-quality patents are Toyota, Hyundai, Bosch, and Denso.

What’s next?

Both financial and patent data confirm that the EV sector has a lot to give in the future of mobility. Patent filings for the chassis control system tell us that this area of the industry is still developing and that we can expect a few surprises in the coming months (pretty much like the one delivered this year at the CES by Sony).

Being the system that provides the “skeleton” for electric cars, improvements in chassis control will certainly enable innovation in the other two major components of EVs — powertrains and batteries. But what are the trends in these two systems? Stay tuned for the next article in the series to find out.

What’s inside Toyota’s patent portfolio for EV chassis control systems?

Fill in the form here to receive the complete report and conduct your own analysis.

Written by Andrea Orivati, Content Writer at InQuartik, and Eugene Lu, Analyst at Wispro Technology Consulting Corporation